Using machine learning to meet customers exactly where they are, in real time

“Meet customers where they are.” It’s a phrase all businesses know well, but what exactly does it mean when recovering overdue accounts?

Essentially, it’s about personalising the customer journey to be responsive to each consumers’ unique needs. In collections, the basis of every personalised experience lies in two elements:

- Where a customer is in their collections journey - for example, have they just been referred into our product, or have they been receiving communications from us for a few weeks now?

- What communication is most likely to engage them at that stage - for example, what information or tone of voice is best suited to a brand new customer? What about someone who has visited the payment portal a few times, but is yet to take action on their account?

Imagine the possibilities - the ability to predict the ‘where’ and the ‘what’, for each individual customer. With InDebted’s collections intelligence, both are identified by our Customer Journey model.

What is the Customer Journey model?

It’s a machine learning model that identifies exactly where a customer is in their collections journey. This means before a communication is sent, the model finds out what (if any) previous interactions or messages a particular customer has already had in regard to their debt.

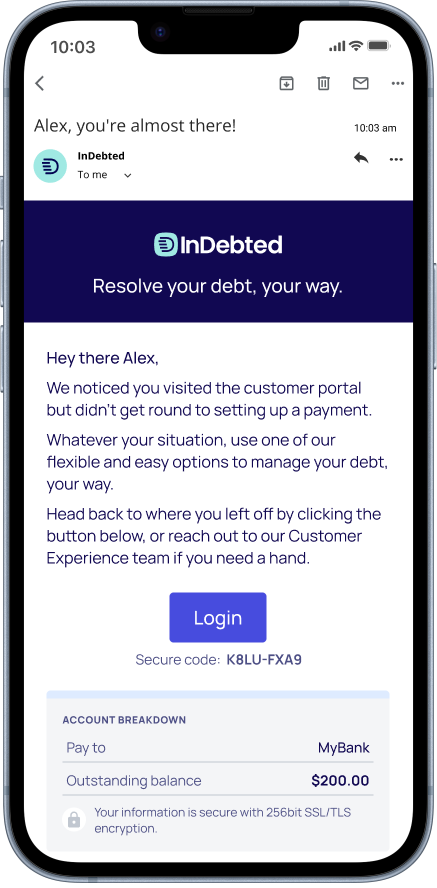

Once the model knows where someone is on their journey, it tailors their next message exactly to this. For example, if someone has visited our customer portal but is yet to take action on their account, the model will send an email similar to the one below.

How does it work?

Using the industry’s largest data warehouse holding over 500,000,000 customer interactions (events), we’ve identified key milestones in the collections journey. This includes customers who have:

- Very recently been referred to us

- Previously set up a payment plan, but it’s since broken

- Paid part of their debt in a single payment, but not the entire balance

- Recently opened a collections email or visited our portal, but are yet to take action on their debt

And more. By tailoring messages to these specific scenarios, our product can create a responsive experience that works best for every individual situation.

Increasing conversion rates by up to 11%

When compared to a control group, customers who have their collections experience tailored by the model are 6.82% more likely to resolve their debt. If we look further at the model’s impact by communication channel, we see an uplift of 7.32% with email and 11% with SMS - highlighting the real value of an omnichannel approach.

And, that’s not all. As a machine learning model, it will become more refined over time. Every interaction, message and event the model learns from informs what it does next. It gets smarter and more intuitive by the second, continually improving performance and engagement.

Learn moreJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Google and Yahoo spam updates: How we achieved a spam rate of 0.2%

Collections emails impacted by new spam requirements? See exactly how we achieved a user-reported spam rate of 0.2%.How we use AI to increase email payments by 32%

Collections communications not landing with customers? See how AI-written collections emails increase payment conversions by 32%.The ins and outs of our Product Roadmap

Get the inside scoop on what's in store for our product, Collect this year.Why 86% of customers prefer to self-serve in debt collection

Stay on hold or do it yourself? Self-serve is the new standard in debt collection. See why it’s a win-win for your customers, and your business.