Omnichannel debt collection: what it is, key benefits, and strategy

You’ve probably heard time and time again about every debt collection agency’s omnichannel, digital debt collection offering, but what exactly does it mean? and more importantly, what does it take to use omnichannel exceptionally well?

Keep reading to learn what sets omnichannel debt collection apart, and how it supports your overdue customers.

What is omnichannel debt collection?

Omnichannel debt collection means being available to support consumers through a variety of channels - whether that’s webchat, phone, email, SMS, or self-serve functionality. When 78% of customers block collections calls from traditional third party agencies, communicating through multiple channels is key to engagement. But it doesn’t stop there - what makes omnichannel different from simply using two or more channels to engage with customers lies in the consistency of the experience.

In collections, this means looking at the end-to-end customer journey, and how each channel forms a vital stepping stone on the pathway to debt freedom. Often, omnichannel debt collection falls into the trap of operating as a silo within a collections function - with separate teams for voice and digital, each following their own strategy, with little appreciation for the disjointed experience this provides.

It’s all well if your agents are expertly trained on negotiating collections calls, but if a customer has to start the whole conversation again when they choose to email you, you might be missing a trick.

When executed well, a successful omnichannel strategy has the power to strengthen the relationship with customers, building trust and empathy. With 88% of customers stating that their experience with a company is as important as their product or service, the investment in crafting that experience should be significant.

Why does omnichannel communication drive stronger engagement?

The answer is simple. No two customers are the same. Especially when it comes to finances - everyone’s situation is unique, and people have different preferences in how they want to engage with a debt collector. This makes omnichannel particularly effective to recover overdue accounts - the intuitive experience supports customers to choose how they want to engage, rather than forcing them down a transactional or repetitive hole.

Omnichannel debt collection delivers 282% higher engagement than voice-only debt collection strategies. By supporting customers with more channels, they’re simply more likely to engage with their debt.

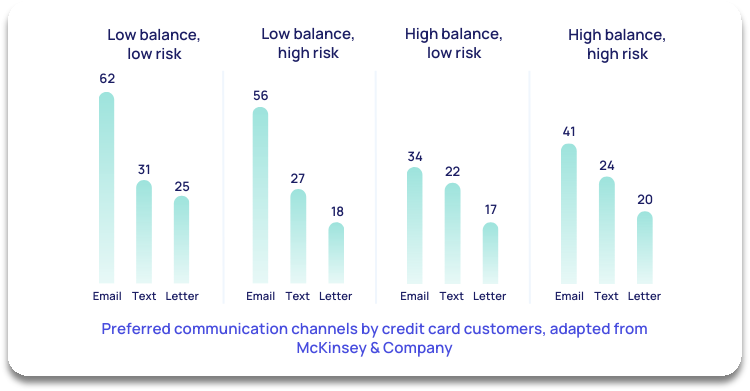

Whether you break it down by generation, debt type, or the number of days past due - the benefits of omnichannel to drive higher engagemare clear. A recent McKinsey & Company study into digital debt collection channels found that across both high and low balances, credit card customers have different engagement preferences when it comes to resolving their debt. While there’s a clear preference for digital channels such as email or text, some people still opt for traditional methods such as letter or phone.

To maximise customer engagement , you need to be truly responsive to the channels people choose. It’s about providing choice for customers to engage with their debt in a way that works best for them.

Other benefits of omnichannel debt collection

While a more streamlined customer experience and higher engagement make a compelling case for omnichannel, there’s many more benefits.

Improved operational scalability: At InDebted, our omnichannel debt collection is infinitely scalable to support high volumes of accounts. Its automated nature means there’s a with low reliance on agent headcount to engage customers, unlike contact centre based collections.

Better data: Digital channels enable far more enriched data than voice. At InDebted, our machine learning models learn from this data to power our Collect product’s omnichannel communication. Predicting how, when and where customers prefer to be contacted generates a 30% uplift in results across engagement, through to liquidation.

How to implement an omnichannel communication strategy in collections

The rise in omnichannel offerings has been seen across industries - particularly as reported in 2022, omnichannel is now the norm for 3 in 4 US consumers. The collections industry should be no exception.

It starts with taking a holistic view of all the channels used for collections communications. These could be digital and non-digital - for example, email, SMS, livechat, phone and mail. From here, it’s about maximising each channel to ensure that customers are getting a consistent, positive experience. Look at:

- What are the conversion rates of each channel?

- What are the response times of each channel? What are the delays to resolution? Are there steps that could be automated, or is additional resourcing required?

- Are customer conversations integrated across each channel? Can your agents see the full picture of the last email conversation, through to the live phone call?

Diving into each channel and treating them as an integrated funnel, rather than an individual way to generate contact, will enable you to drive better customer experiences and more efficient payments.

Looking at the data will also enable you to get a deeper understanding of your customers, along with richer insights into both their engagement and behaviours. These can provide meaningful context to what your customers need and enable you to create a collections strategy that truly meets them where they’re at.

Learn more about omnichannel debt collectionJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

5 expert-backed tips for working with multiple collection agencies

Diversifying your collections panel can be a game changer for your organisation.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.The state of financial wellbeing in Australia, the United Kingdom and the United States, and how collections can support

How are your consumers coping financially? See the state of financial wellbeing across key markets, featuring the latest insights and practical actions for supporting stretched customers.