The relationship between customer retention and collections

Nothing impacts your bottom line as dramatically as customer retention. These two stats alone say it all:

It costs five times more to attract a new customer than it does to retain an existing one.

Investing 5% more in customer retention can increase profits up to 95%.

But what happens if loyal customers start to fall behind and overdue accounts creep up? With 2 in 5 saying they’d stop using a brand after only two negative experiences, how can you recover revenue while ensuring your customer experience doesn’t falter?

Let’s unpack how the right collections experience can do more than recover unpaid balances, but work harmoniously with retention efforts to extend your customer lifetime value.

What’s the link between collections and customer retention?

When customers fall behind on payments, it’s fair to assume that their relationship with your brand could be cut short. But this doesn’t have to be the reality. As our VP Growth, Hugo Rajotte explains:

“Some people might think that that customer’s relationship with the original brand might be over, but that’s not the case because circumstances change for customers. And if you can rehabilitate them, they can become a customer again - a performing customer, then the acquisition cost for that customer is much lower than it was originally.”

Supporting customers to get back on their feet - in a way that truly works for them, means their original relationship with your brand can be restored. Rather than collections being a damaging experience that leaves customers feeling burnt, it can be flipped to a positive one that provides ease, support and flexibility.

But with Finance leaders stating that only 21% of customers are satisfied with their collections, how can you connect the dots between recoveries and retention?

Think of collections as an extension of your customer experience

Every interaction you have with your customers is an opportunity to build the relationship. That includes collections. Rather than leaving customers feeling punished or shamed, you can in fact strengthen their loyalty.

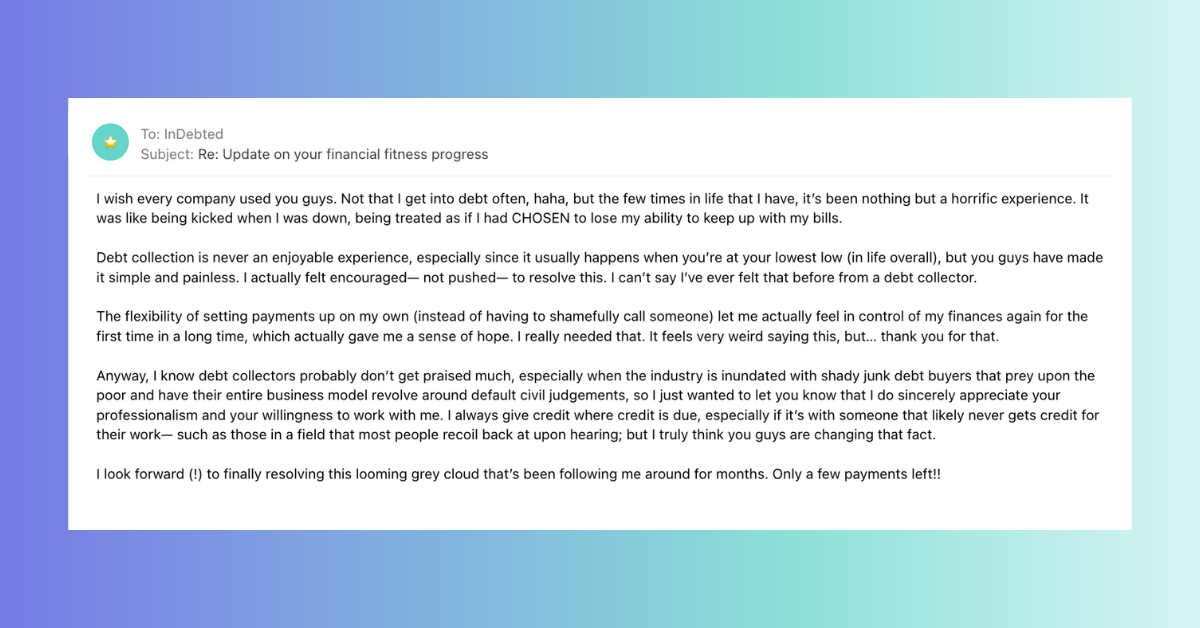

Carried out correctly by the right provider, collections can in fact give customers an enhanced perception of your brand. How? By treating them with the same care, attention and support when getting on track, as you would when they’re purchasing your products or services. This customer review brings the point home:

Choose a partner who understands that you’re trusting them with not only your overdue accounts, but perhaps more importantly, your customer relationships. It’s all too easy to alienate consumers with a poor recoveries experience, so ensure that your provider meets your standards for customer satisfaction. Consider the following:

- What’s their philosophy towards debt? How do they value the customer experience? Is this mirrored in their own company values and team?

- What do customers say about their experience with the collections agency? Can you see their Google reviews, and what’s their average rating?

How do you create a collections experience that fosters customer retention?

Let’s get into the details. Understanding what creates the ultimate collections journey means stepping into your customers shoes and considering what you’d expect from your brand if you fell behind. As well as ensuring your revenue recovery mirrors your values, it should also include:

Freedom to self-serve and manage an overdue account independently.

The vast majority of transactions can be done online without interacting with a Customer Service team. With a digital-first collections experience such as an online payment portal, customers can have autonomy to resolve their balance on their own time, at their convenience.

Omnichannel engagement to provide a consistent experience across all touchpoints.

78% of people are frustrated by disjointed communication across different channels. It’s more important than ever to not only meet customers where they are, but meet them with the information they need.

Flexibility in payment options and methods to fit individual situations.

Weekly payment plan, pay in full, or something in between? Every customer should be able to decide exactly how they make repayments that suit them.

Personalised experiences tailored to individual preferences and behaviours.

71% of people expect personalised interactions with organisations. Every collections experience should demonstrate how well your partner understands your customer base and personalise their engagement.

Friendly Customer Service team offering a helping hand.

For people who reach out to speak with someone, it’s key that they’re met with a compassionate team member on the other end. You want every interaction your customers have with collections to be encouraging and positive, especially if they need extra support.

Final thoughts

It all comes down to trust. Your customers trust you to keep them in safe hands and provide a great experience, and you need to be able to trust that your revenue recovery partner can meet that expectation. If all boxes are ticked, retention is far more likely to flow naturally. Collections don’t have to be the end of a customer’s journey, it can be a whole new beginning.

Learn moreJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.Stop losing subscribers: the proven revenue recovery strategy that turns churn into retention

Involuntary churn is costing subscription businesses loyal customers and revenue. Recover missed payments and reduce churn with an alternative approach.