The United States economy and its impact on debt collection

In the latest episode of Better Debt, our panel covered all things related to the United States economy, credit and collections. With a comprehensive analysis provided by Dan Simmons, Senior Director of Financial Consulting at TransUnion, let’s take a closer look at the trends impacting the economic climate in the US, and their potential implications on the collections industry.

Macroeconomic update

The overwhelmingly good news - the US economy has remained resilient. In Q3, economic growth was up by 4,9%, a promising figure which has primarily been fueled by consumer spending and a strong labor market.

Despite fears of a looming recession, a recent survey of economists found that less than 50% believe this will eventuate. Even so, there’s a consensus that the rate of growth in coming quarters is likely to slow due to rising interest rates. Inflation has been trending in the right direction, but rates are expected to remain higher for longer in order to reach the target rate of 2%.

An overview of the credit market

This year, we’ve seen a 1.3% increase in the percentage of consumers in below prime tiers when compared to Q3 2021. The increase reflects the change in lending practices over the last three years, as at the start of the pandemic lenders initially tightened standards given the market uncertainty. As the situation started to improve, standards started to ease again in 2021, which is now translating into higher delinquency rates.

To respond, lenders have resorted back to a more conservative approach, which has reduced origination growth across all products. But, high inflation means that balance levels for all products are at an all-time high, which leaves consumers feeling the pinch.

What does this mean for collections?

- Placements are expected to remain high, but with stricter lending standards future growth may be limited.

- Given a surge in balance levels for all products, dollar amounts for placements will increase. However with greater financial pressure on consumers, recovery rates could be challenged.

- While the job market has been a silver lining for the economy, any weakness in this area could push charge-off totals even higher.

Consumers are showing signs of increased pressure

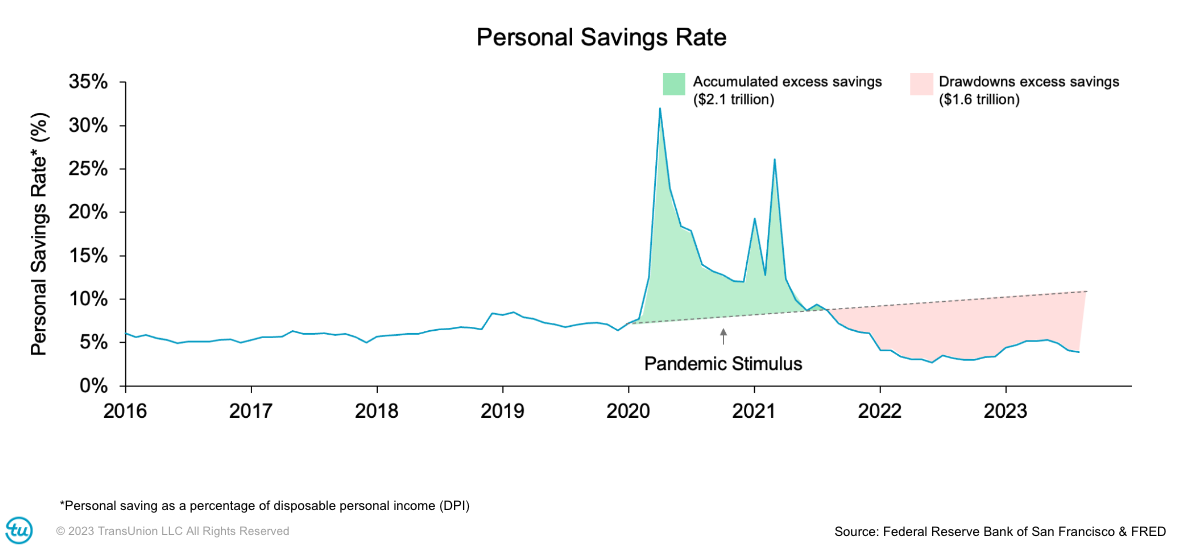

Personal savings rates saw a sharp decline in mid-2021 - and continue to remain low. We’ve seen a significant drawdown of $1.6 trillion, a stark contrast to the spike in savings at the start of the pandemic:

Turning to overall consumer health, Dan referenced TransUnion’s aggregate excess payment (AEP) as a key indicator, which measures how much more a consumer can pay beyond the minimum payment amount. Over the last few years, we’ve seen a decline in AEP which means that fewer consumers are able to make extra payments each month - demonstrating that more are feeling the pressure.

What does this mean for collections?

As consumers have less savings to fall back on, it’s more important than ever to offer flexibility in repayments. This means more options such as customizable payment plans that give consumers the autonomy to tailor the start date, frequency and amount to what they can afford.

Trends in unsecured personal loans

Originations have seen a decline since 2022, but in comparison to the last few years, totals are still elevated. Saying this, the conservative shift in lender strategy has had positive effect on origination growth and delinquencies:

- Origination growth has decreased in the below prime buckets as lenders are reducing risk in these portfolios

- With each progressive quarter, fewer accounts are becoming delinquent

Balances have increased 50% over the last two years in unsecured personal loans, however a greater percentage of these are being held by super prime accounts - a 3.2% increase from 2022.

What does this mean for collections?

- The lender reaction to high delinquencies and reduction in originations could potentially reduce placement volume for unsecured personal loans.

- Dollar value of placements are expected to grow, both in total and on an average account level.

- As serious delinquency levels remain high and charge-off totals are rising, near-term placements could increase.

Trends in bankcards

When compared to 2022, below prime bank card originations are down by 5%, whereas prime and above are up by 5%.

On the flip side, when it comes to delinquencies we see the opposite picture to unsecured personal loans. Bankcard delinquency rates have reached their highest level since 2009 and more accounts are becoming delinquent earlier across all tiers, leading to higher charge-off totals.

Where balances have soared, the pressure on bankcard consumers is exacerbated with soaring interest rates (currently at 21%). We see this increased stress reflected in utilization rates, as more consumers have a utilization rate of over 90% - although these numbers are still lower than pre-pandemic levels.

What does this mean for volumes entering into collections?

- Ongoing pressures mean you should continue to expect increased volumes of placements in collections, despite lower origination growth.

- As with unsecured personal loans, dollar amounts of placements in collections are likely to grow in total, and on an average account basis.

- With increasing charge-offs and delinquencies, near-term placements are also projected to increase.

It’s clear that while we may have escaped a recession, the economic climate is still fragile, and consumers need support to ease the pressure.

To catch up on Dan’s session, click the button below.

Watch the recordingJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.Stop losing subscribers: the proven revenue recovery strategy that turns churn into retention

Involuntary churn is costing subscription businesses loyal customers and revenue. Recover missed payments and reduce churn with an alternative approach.