Things to consider when scaling your business, and collections

Scaling your business can be stressful. Whether expansion is regional or international, it’s a lot of work to grow the essential cogs that keep your business running.

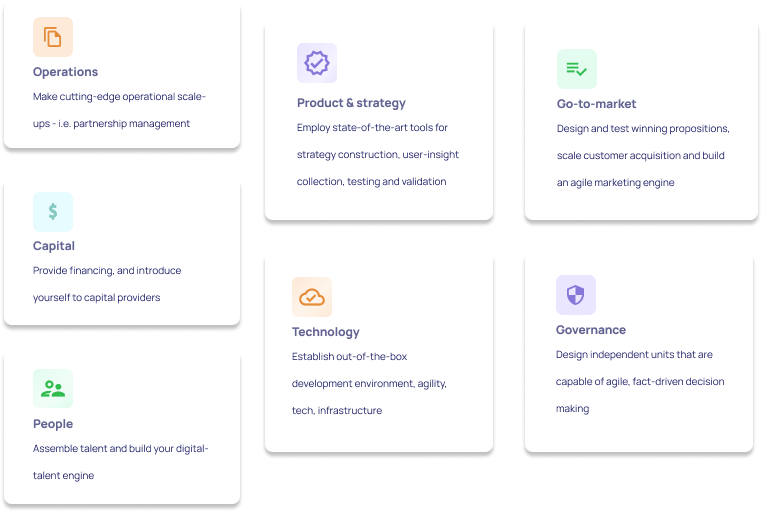

With only 1 in 5 businesses scaling successfully, what exactly differentiates the 20%? McKinsey & Company identified seven key areas that separate those who successfully expand:

Adapted from McKinsey & Company

When it comes to taking recoveries with you as you scale, the same level of careful planning is needed. Here, we’ll walk you through the steps to consider when expanding both your business, and your collections into new markets using the above framework.

Operations

Does your collections provider have the capacity to enter a new market?

Scaling is a massive operation, especially when determining how thousands of new customers will be supported. The first step is understanding whether your existing provider can handle a large influx of new customers. If you’re working with a traditional collections agency, consider:

- Will they need to add headcount in their contact centres, QA and compliance teams to service customers effectively?

- Do they have the infrastructure - will new offices need to be opened or hardware purchases?

- Can they train these new employees effectively?

- How long would it take to increase these resources? And most importantly - what’s the cost to you?

With the digitisation of debt collection in recent years, you’re likely working with a provider who implements some level of digital recoveries. Here, you should ask:

- Are existing tech stacks strong enough to support such growth?

- Would there be an impact to performance with an influx of new accounts?

In most industries, building capacity means increasing headcount and adding technical infrastructure, at the very least. The cost? Mobilising for such growth often comes with growing pains. Time needed to recruit, embed new systems, implement training processes, are just a few of the common time delays experienced with scaling capacity - let alone the financial implications of delayed targets. Understand what procedures your collections partner has in place for meeting a new volume of accounts, and what the potential performance implications could be during the transition.

Governance

Is your partner governed by the appropriate licences and compliance measures?

Debt collection is a highly regulated industry with regulations specific to particular regions, states and countries. When taking recoveries into any new area, a primary focus is to understand whether your existing provision holds the correct licences and upholds the relevant regulations required by that particular jurisdiction. Requirements vary region to region and seeking expert guidance on whether your provider needs to obtain authorisation to collect in your new location, and the processes required to do so, will be a determining factor in understanding if you will need to vet alternative collections solutions.

The vast majority of collections agencies are localised, simply due to the complexity of obtaining and upholding multiple licences. It’s common for creditors to have multiple collection providers for different regions and whilst this spreads risk, it also presents a number of logistical and strategic challenges. Assessing recovery performance and comparing data is less reliable, as the comparison isn’t ‘like for like.’ With no two providers being the same, additional collection provisions can result in an uneven customer experience for your new consumer base - which if possible, should be avoided.

People

Are collections delivered by the right people who understand your customer base?

Consumer expectations have grown significantly over the last five years, accelerated by the pandemic. Sparing no industry, today’s average customer expects the ability to access support at their convenience, along with friendly customer service and a seamless user experience. The collections industry has been slow to innovate beyond making phone calls and sending letters, and the disparity between consumer expectations and the average recovery experience is greater than ever before.

When stepping into new regions with any collections provider, consider the needs of your customers and screen partners accordingly:

- Do they understand your customers’ demographic and their behaviours?

- Have they worked with similar debt types previously?

- Do they understand how your customers typically engage with service providers? What channels do they prefer to use?

- Does their product or service have a digital self-serve offering?

- What type of customer experience and relationships are you looking to create?

All the above and more are vital to understanding your expanded market, and the collections partner you choose is by default, an extension of your own product and services. The risk of not considering this can have negative consequences to your reputation like unfavourable reviews and even legal action. Get a sense of how your provider understands your consumers and their efforts to explore who they are, what makes them tick, and how collections activity is tailored to their behaviour.

Capital

What is the financial cost of scaling your collections?

For businesses who collect in-house, the cost of scaling your own provision should be factored in during initial expansion planning. Consider the above with your internal teams, as well as:

- Are there additional language considerations that need to be factored into recruitment?

- Will collections communications require translating?

- What additional training is needed for collection agents on new regulations?

- What is the compliance risk for human error?

- How will collections communications be adapted in line with regulatory requirements as they vary from region to region?

- Will there be changes to working hours? How will this be managed?

- Does existing data management fall in line with what’s required?

Working with an experienced provider in your new region will mitigate the above, as managing collections activity across multiple regions should be executed by a known agency or seasoned leader.

Product & strategy

Are your collections appropriate for a new customer base? Does it take nuances into consideration?

Look deeper into how your existing provider carries out recoveries and how strategy is determined. Dive into all collections communications as well as the strategy that binds them together:

- Voice: How are outbound calls carried out? Are scripts used? Are these culturally appropriate for your new market?

- Email: What templates are used for emails? Will these require translating? Have they been performance tested with a similar customer base?

- SMS: Is this carried out in your new region? What templates are used? How are relevant laws and regulations followed?

- Engagement strategy: Are communications targeted? Are customer profiles segmented? How are customer behavioural and engagement insights applied to strategy?

Product and strategy considerations are particularly relevant if you’re working with a digital collections provider. Unpack the inner workings of all collections communications to get a clear picture of how they will align with your new customers.

Go-to-market

What is the collections landscape in your new market? Is your solution fit?

Like every market, collection practices vary from region to region. The value in developing a deep understanding of your consumer base and ensuring that all activity is aligned with their preferences and behaviours is a step towards scaling success. Take the time to uncover the collections environment in your new region:

- How do local collectors typically carry out recoveries?

- What are the standard engagement and performance rates?

- How have recent regulatory changes impacted collection practices?

- Who is the regulatory authority and what are their current key drivers?

We discussed the disparity between consumer expectations and the development of collections, and considering the above questions will give you and your provider a threshold. A benchmark to understand where recoveries should be - at a minimum. Scaling into a new market and retaining that position means establishing a foothold, and a positive reputation. Work with a collections provider whose activity will support you in that goal, which in their case will mean raising the bar on standard collections practice.

Technology

How can technology and data maximise collections? Can you leverage data from other regions and customer bases to strengthen impact?

The very idea of expanding into new regions is made possible by technology. However, rarely do collection agencies fully understand how to unlock its full potential and apply evidence-based insights to improve their customer engagement strategy. When determining the right partner in your new region get a handle of:

- What systems are in place for collections activity?

- Who are the people responsible for managing those systems?

- What protections are placed on business and customer data?

- Are they certified to global standards?

- How is compliance built-in?

- How are insights informed by real data used to improve the collections experience?

- How are uplifts and improvements carried out?

Whilst digital collection agencies are more frequently appearing in the industry, put your candidates under the microscope to determine how technology is used not just to carry out activities, but also to improve them. Leveraging data insights and applying these to more than collections, but your own internal strategies will allow for a cohesive approach when entering any new market.

Collect beyond the scale

There’s a lot to weigh up when expanding into new markets. The main takeaway when scaling your collections is to look for a partner who can operate compliantly, with the systems and resourcing to collect efficiently, and with a deep understanding of the local market. Look at how your collections partner fits into the bigger picture to determine whether they’re the right fit for your business, and your customers.

About InDebted

Consumer expectations have changed. Debt collection hasn’t.

From accessing credit to buying new shoes, today’s consumers opt for transactions that are frictionless and digital-first.

Meanwhile, the debt collection industry hasn’t evolved beyond outdated communication methods, intrusive tactics, and pressuring experiences. When life can change overnight due to work, family, or health, people shouldn’t be punished for falling behind on payments or missing a bill.

Nobody can change the fact that debt happens. But we can change the experience of being in debt, by creating a better way for businesses to support consumers through it.

Businesses partner with InDebted to help their customers get back on track because we’re changing the world of consumer debt recovery for good.

Our Collect product delivers up to 40% increased recovery performance, while being the world’s highest rated debt collection solution for customer experience.

We call it intelligent debt collection. It’s emotionally intelligent, digitally intelligent, and intuitive to the needs of every person, everywhere.

Book a demoJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.Stop losing subscribers: the proven revenue recovery strategy that turns churn into retention

Involuntary churn is costing subscription businesses loyal customers and revenue. Recover missed payments and reduce churn with an alternative approach.