Google and Yahoo spam updates: How we achieved a spam rate of 0.2%

In October 2023, Google and Yahoo announced new rules from February 2024 to crack down on spam rates, applicable to bulk senders issuing over 5,000 emails a day.

Our spam rate sat at 0.5% on average - far lower than industry standard for collections agencies, who have spam rates of 5-10%. However to further protect our email delivery rates and minimise impact to email collections, we set a goal of reaching 0.2% spam rate.

What are the new requirements?

- Reduce user-reported spam rates: Keep user-reported spam rates under 0.3%.

- Easy unsubscribe options: Include one-click unsubscribe, and a clearly visible unsubscribe link in the message body.

- Authenticate email domains: Follow best practices to authenticate email domains, to ensure Google and Yahoo can confidently rely on an email’s original source.

How do the new requirements impact debt collection agencies?

If we put it into perspective, Gmail accounts for over a third of opened emails globally and Yahoo has around 225 million active users per month. As collections agencies contact thousands of customers each day by email, these requirements are significant.

InDebted is no exception. It’s our main communication channel. We send over half a billion emails annually, from NOAs and inquiry responses, to receipts and reminders.

How did we prepare for the new requirements?

1. Analyse email engagement insights

To reduce user-reported spam rates, we analysed our email communications with a view to enhance effectiveness and improve engagement.

Segmentation: Customers report spam differently

The more overdue the balance, the more likely a customer is to mark a message as spam. This suggests that someone’s financial situation might influence their perception of a collections email. To take this insight on board, we created targeted email communications that prioritise empathetic messaging to help these customers feel empowered and supported to engage with their debt.

In contrast, customers with a lower tendency to mark emails as spam are more likely to engage with more email communications (within regulatory contact limits). This provides more room to adjust contact frequency based on customer sensitivity to improve engagement while minimising risk.

It’s all in the timing

One of the most significant factors determining whether a message will be marked as spam is the sequence of emails. This has a greater impact than the message itself, or the volume of emails sent. This means we can adjust our email delivery machine learning models to focus on the order of messages to optimise engagement and reduce spam reports.

Other findings when it comes to the timing and frequency of emails include:

- Customers are more likely to mark emails as spam on the weekends, even though no new emails are sent on Saturdays and Sundays.

- Customers are most likely to mark messages as spam on the 11th email, with 61% of spam markings happening on the day the email is sent or on the following day.

These learnings give us specific direction to adjust the timing and frequency of our emails to align with customer preferences, improve engagement and reduce spam reports.

2. Introducing our latest machine learning model: Spam Predictor

To reduce spam report rates, our Spam Predictor understands the probability of an email being marked as spam by a customer. Trained on years of email spam data insights, it works alongside our existing models (including the Customer Journey model, the Message Scheduler and more) to:

- Personalise the frequency of email communications at a customer level

- Tailor messages to customers that are more likely to mark an email as spam

- Better select non-email channels to communicate with customers

As with all our machine learning models, the Spam Predictor will become more intelligent with every interaction. This means it will automatically produce more precise recommendations over time, serving as a continuous spam reducing tool.

3. Increase brand trust with email refinement

When it comes down to it, the drive behind the new regulations is trust. Brands need to go the extra mile to earn not only consumer confidence, but the email providers too. With this in mind, we added a number of new refinements:

- One-click unsubscribe: Customers can unsubscribe from email communications with just one click. This intuitive design choice makes unsubscribing a more accessible and immediate option than reporting an email as spam, further reducing spam rates.

- Inbox brand logo: To establish trust from the get-go, customers will now see InDebted’s logo next to our emails in their Google or Yahoo inbox. This enhances their confidence in opening and interacting with our messages, and reduces the likelihood of emails being mistakenly marked as spam.

- Email validation: To protect against bounce rates and preserve our sender reputation, customer email addresses will be even more thoroughly validated before any messages are sent. This enhances our delivery rates, maintains compliance and further optimises our campaigns.

Impact

Since the rollout of our spam reduction measures, our user-reported spam rate across our primary ‘InDebted’ domain is 0.2%. Our subdomains go even further, with an average daily rate of 0.1%.

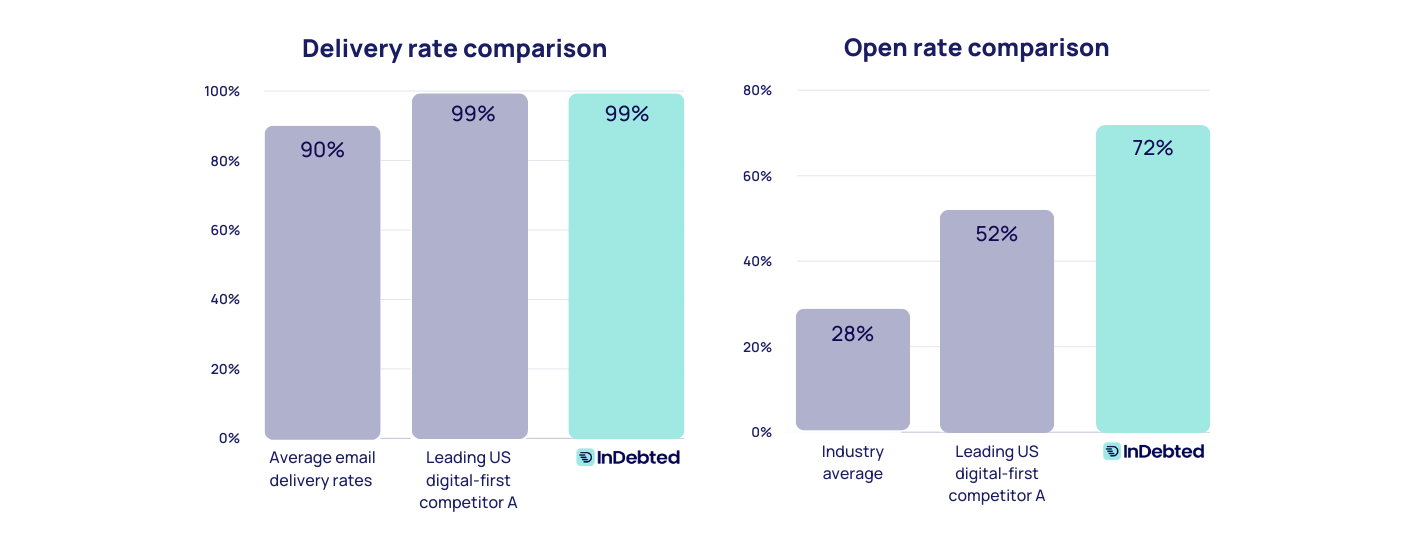

When we look at our email performance in comparison to our peers, our impact is significant:

It’s clear the new requirements are essential to meeting provider expectations and customer preferences. With email becoming increasingly popular in collections, it’s vital that we use the channel in a way that’s compliant, effective and considerate. This means leveraging data insights to inform our strategy and produce results that deliver without compromising performance. This ensures we continue to set pace for the future of digital channels in the collections industry.

Learn moreJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Google and Yahoo spam updates: How we achieved a spam rate of 0.2%

Collections emails impacted by new spam requirements? See exactly how we achieved a user-reported spam rate of 0.2%.How we use AI to increase email payments by 32%

Collections communications not landing with customers? See how AI-written collections emails increase payment conversions by 32%.The ins and outs of our Product Roadmap

Get the inside scoop on what's in store for our product, Collect this year.Why 86% of customers prefer to self-serve in debt collection

Stay on hold or do it yourself? Self-serve is the new standard in debt collection. See why it’s a win-win for your customers, and your business.