AUSTRALIA

Next-generation solutions to traditional collections in Australia

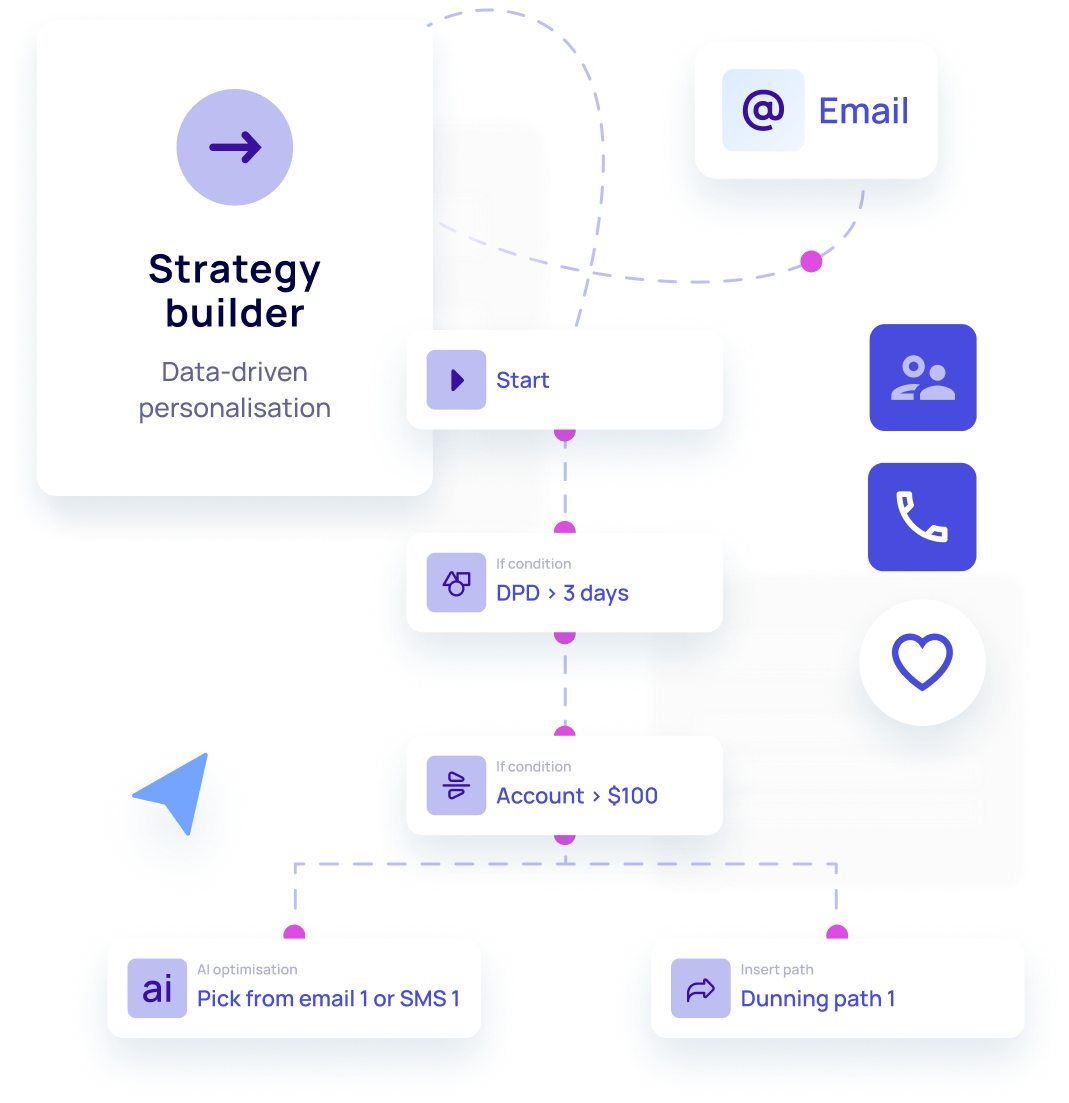

Replace legacy first-party systems

Remove inflexibility with modern collections infrastructure, built for enterprise. Including consultative support, Receeve delivers adaptive strategies with enhanced control.

Explore Receeve

Smarter third-party collections

Collect delivers personalised experiences, built-in compliance and deeper insights to take your collections further - every time.

Explore Collect

“InDebted has been on our panel since the very beginning. They’ve proven to be very effective and always shown a willingness to support our growth agenda, enabling us to continue to develop our business with confidence.”

Mark Spiro

CEO

Michael Chatfield

Managing Director, Australia

Alex Ineson

Strategic Client Solutions Manager

Sandy Sharma

Strategic Client Solutions Manager

Tyler Vivian

Head of Operations

Adel Megdyatova

VP, Performance & Analytics

Nick Krauspe

Head of Compliance, AU & UK

Compliant by design

Intelligent strategies that adapt with you

A better experience for your customers

Vulnerability detection

Collect’s AI proactively flags customer accounts in need of support, fast-tracking them to specialist attention.

Flexible payment options

Custom start dates, payment amounts and frequencies are all part of the payment experience.

Agents who care

The industry’s highest rated customer experience, with a 4.9 average from over 2,700 5 star reviews.

“Excellent client services and engagement. Their team is always ready to help. Their monthly reports offer advanced insights into the current market trends in debt collection, which helps us in our decision-making process.”

Murali V

Operations Manager, Collections & Hardship

Find licensing information where you operate

Select a country to find more information

InDebted is the modern alternative to traditional debt collection agencies in Australia. We partner with leading Aussie brands such as Zip, Klarna and Cash Converters to deliver stronger performance outcomes and better customer experiences. Our model replaces legacy methods such as dial-heavy strategies with personalised engagement which includes omnichannel engagement, self-serve payment portals and flexible repayment options designed for Australian consumers.

See the experience

High-growth companies across fintech, BNPL and financial services work with InDebted because we combine deep local expertise with advanced AI-driven technology. Our approach balances compliance, performance and customer care, giving leading businesses the confidence to scale while protecting their brand experience. Clients such as Klarna and Cash Converters see dramatic uplifts in liquidation and customer satisfaction by partnering with InDebted.

Read our client stories

Our proprietary AI technology powers every aspect of our solutions, from strategy design to vulnerability detection. At its core, it analyses billions of customer interactions to predict the best way to engage each account at a personalised level.

In our first-party solution, Receeve, AI is used across execution, from behavioural scoring to strategy optimisation. Receeve’s AI works only with your data to train models, maintaining strict first-party standards.

Learn more about Receeve’s AI

With Collect, clients benefit from our global Data Lake, which holds more than two billion customer insights. These insights are applied by machine learning models to optimise every touchpoint in the collections journey, from channel selection to timing and messaging, maximising engagement and conversion.

Learn more about Collect’s AI

AI also underpins our approach to compliance. It enables proactive vulnerability detection, so we can identify customers who may need additional support and ensure they receive it at the right time.

Yes. Outbound voice is a core part of our collections strategy in Australia. We use AI to identify which customers are most likely to respond to voice and focus our calling strategy where it will make the greatest impact. This ensures voice is used strategically, leading to better outcomes for clients and a more respectful, less intrusive experience for customers.

Our local agents are backed by custom training programs and rigorous QA processes, focusing not just on what they say, but how they say it. Rated 4.9 stars on Google by over 2,700 customers, demonstrating our unwavering commitment to customer excellence.

Explore customer care

We work with a wide range of Australian businesses including fintechs, BNPL providers, major financial institutions and debt purchasers. Our solutions are designed for growing businesses that need a modern alternative to traditional methods, with proven results across industries.

Speak with Sales

Personalised journeys informed by AI behavioural scoring

Personalised journeys informed by AI behavioural scoring