Evolving your collections strategy beyond linear to intelligent

By Tracy Glen: Chief Client Officer

In this guide we’ll look at how collection strategies are typically formed, what’s considered during their development and most crucially, how they can be improved.

Champion and challenger strategies, risk scoring, segmentation - you’ve probably heard it all. Collections agencies are dedicated to taking their strategy development to the next level to advance recovery performance and conversion rates. But where these collections strategies were once innovative, their linear nature means they fail to be responsive to how consumers actually want to engage with their debt.

We take a critical lens to the standard collections practices used by most agencies today and discuss how personalisation, data and digital channels enable an entirely new solution that can maximise collections outcomes.

Part one: How can debt collectors match modern consumer behaviours?

Before diving into the details of collections strategies, let’s set the scene on how today’s consumers make purchases, seek support, and manage their accounts.

Drive to digital channels

It’s no secret that the modern consumer prefers engaging with businesses through digital channels such as webchat or email when compared to more traditional channels of seeking support like picking up the phone. Between 2019 and 2021 digital transactions increased by 36% as the pandemic accelerated the uptake.

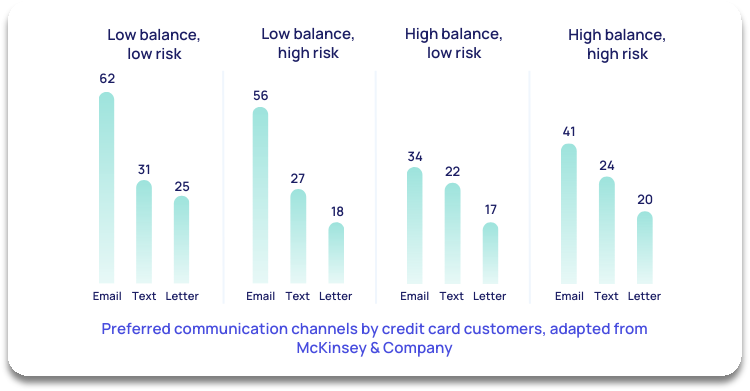

In a 2019 McKinsey study on the rise of digital channels in debt collection, across all risk categories and balances, email was the preferred engagement channel for credit card customers. SMS came in second, with phone calls and letters trailing behind. Meanwhile, the practices of traditional debt collectors aren’t keeping pace with evolving consumer preferences. In 2022, Transunion found that over 90% of agencies still use manual dialling (telephone) and letters as their primary communication methods.

Convenience above all

With digital accessibility ever increasing, customers in all industries are drawn towards services and transactions that offer this level of convenience. Layers of friction and delays to resolution are an immediate turn off, with 44% of consumers stating convenience as their reason for switching brands. However in debt collection, they have no choice in their provider - so their only option is to disengage from their debt entirely.

Supporting customers to self-serve their accounts means enabling them with digital autonomy, and a convenient experience.

4 in 5 customers referred to InDebted manage their debt independently, with no interaction at all from our Customer Service team.

It’s clear that the overwhelming majority of customers want the option to resolve their accounts on their own time, in a way that mirrors the digital first experience they receive in other day-to-day transactions.

Increased digital offerings and generational shifts

From virtual chats to digital banking, all industries have used technology to evolve their customer experience across. Across the board, consumers now expect:

- Immediate availability of customer service agents

- The ability to communicate through digital channels like webchat or email

- Seamless and straightforward user experience (Apps, website)

- Brands with strong social values

- Strong information security protocols protecting their sensitive data

- A commitment to compliance with relevant consumer protection laws or regulations

In financial services, only 31% of consumers worldwide view the sector as being successful at using technology to create great customer experiences. To add to the disparity, the widespread adoption of advanced tech like AI will inevitably drive consumer expectations even higher.

The Millennial effect

In 2019, Millennials officially surpassed Baby Boomers as the largest generation in the US. While this is a natural societal progression, this shift in balance is worth noting. This generation have their own set of expectations and behaviours, dramatically different from their predecessors:

- Rarely have landline telephones

- Texting is their preferred communication method

- Many won’t answer calls from unknown caller IDs

- Many have never activated or checked their voicemail

Engagement tactics need to be targeted to who they’re trying to reach. This means considering the channels, messages, and even the times that communications are sent. Millennials are the most tech savvy generation, with 66% opting for self-serve and 65% preferring digital engagement. Applying these insights to any collections strategy is a must.

Part two: Linear collections

Collections strategy development has come a long way in the last few decades. The original ‘smile and dial’ philosophy has been replaced by in-depth data analysis, risk scoring and segmentation. All are now integral features to create a ‘successful’ plan of action. However, how can collectors evolve the tools and channels used to communicate with customers beyond this?

Let’s dive into the details.

How linear strategies are developed

Step 1. Segmentation: Risk scoring

Risk-based collections are formed from the idea that not all customers will respond equally to the same recovery effort. Applying this means grouping accounts according to how likely they are to fall into arrears, or default. It’s a straightforward concept that relies on a basic understanding of who your customers are and how they typically behave. But how is risk assessed? Enter, scorecards.

Scorecards are created using statistical models that analyse customer data to determine how likely an account is to default. They use different factors to assess risk, for example:

- Account balance: higher account balances generally point towards greater risk.

- Payment history: a track record of consistent, on-time payments are aligned with lower risk scores.

- Age of debt: older debts are typically considered higher risk, as they may be more challenging to collect.

- Financial stability: overall financial stability including income, employment status, and credit score.

- Industry or geography: type of debt and where the customer is located can also be used.

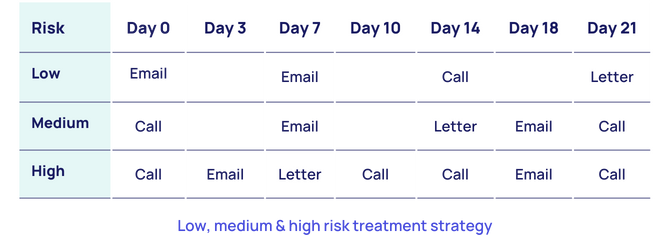

The models assign different weights to the above variables, for example location will have less impact on the overall risk score as opposed to payment history. Data is entered into the scorecard, an individual risk score is calculated for each account, then the accounts are categorised into risk bands - typically low, medium or high. All accounts in the same risk band receive the same treatment, which intensifies as risk increases. Essentially the higher the risk score, the more intense the engagement for those accounts.

Step 2. Implementation: Treatment strategies and engagement

Risk scoring is all well and good, but it’s only as effective as the engagement methods applied to each segment. We briefly touched on the channels most used by collectors today in part one, which are letters (95%) and manual dialling (91%). Saying this, the use of digital is slowly growing with 62% using email and 37% SMS.

The treatment plan for any risk-based collections strategy is designed specifically for each risk group. For example, let’s take accounts branded as high-risk, large balance. These are the most ‘problematic’ and need greater investment to be recovered like:

- Frequent and early engagement

- Reliable (and usually more expensive) collections avenues including letters, outbound calls, and litigation

- Strong messaging

You can apply the opposite thinking to low-risk, small balance accounts that have reduced contact throughout the collections cycle.

Depending on the number of accounts in each category, hundreds of thousands of customers can be receiving identical treatment. The chart below gives an idea of how engagement intensifies according to risk, in terms of frequency and channels used.

Messaging will also vary between each group. High-risk customers are often sent communications with a serious tone to encourage resolution - but this can easily have the opposite effect. Regardless of which band a consumer is placed into, their individual communication and engagement preferences are entirely overlooked.

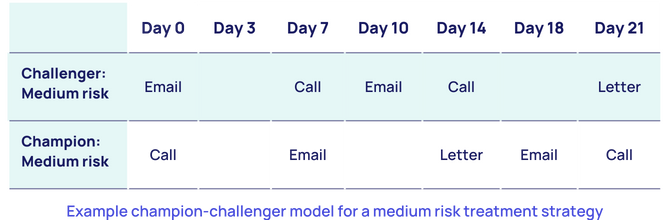

Step 3. Tracking and improvement: Champion and challenger

As with any engagement strategy, measurement is everything. Collectors need to understand how individual channels are performing, as well as the overall success of a treatment strategy. Diving into specific channels can be tricky especially with more traditional methods like letters. On the other hand whilst digital methods are easier to track, many struggle to measure performance beyond basic metrics. At regular intervals, collectors assess liquidation and conversion rates to determine the strategy’s overall success, which risk groups are meeting targets and which need to be improved.

After opportunity areas are highlighted, a champion-challenger model can be introduced. This is where a contact strategy is put to the test against an alternative, or ‘challenger’ strategy. Here’s how they work:

In this example the frequency and communication channel are both being tested. Let’s say there’s a total of 100,000 accounts in the medium-risk group. A portion of those (for example 20,000) will be placed in the challenger model and the rest remain in the champion strategy. Performance of both groups is tracked over several months to determine the overall success of the challenger model. Essentially a form of A/B testing, it’s a safe way to improve and see the overall impact of small or large changes to any treatment model.

The oversights

Now we’ve seen what goes into a typical collections strategy, let’s consider what’s missed and most crucially, what the impact of that oversight is.

Segmentation isn’t enough

Grouping accounts into buckets based on specific criteria makes sense, and the use of scorecards introduces a new level of sophistication. What’s taken for granted is that hundreds of thousands of customers are given the exact same collections treatment. Let’s put this into perspective.

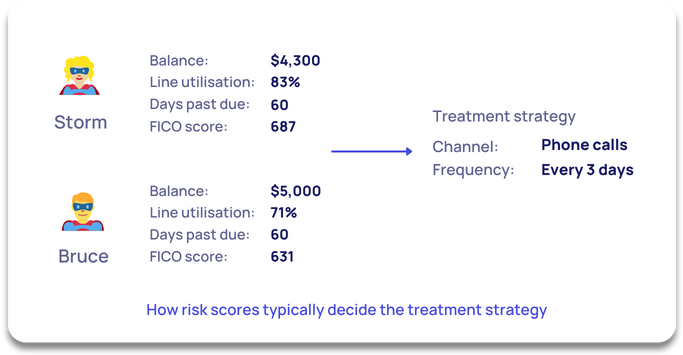

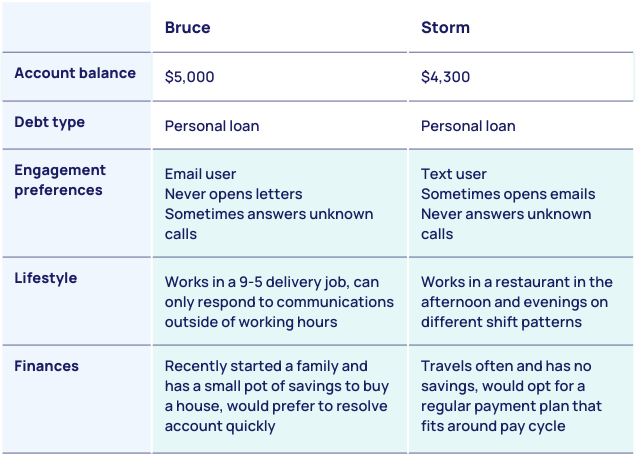

Let’s bring back Storm and Bruce. How will this approach determine their treatment if they both have the same risk score?

At a quick glance their demographics and account types seem similar - both have the same debt type and balances less than $5,000. When we start to dig a little deeper however, it’s clear that their profiles are entirely different. From their working lives to financial capacity and engagement preferences, giving both customers the exact same treatment would have remarkably different outcomes.

Although risk scoring allows collectors to start building a picture of an account, it simply doesn’t tell the whole story. It enforces a cookie cutter approach, which assumes that because customers may have similar accounts, they want to engage with their debt the same way. It’s clear that looking at collections purely from a risk perspective leaves out these crucial details:

- How does this particular customer want to be engaged?

- What channels do they regularly use?

- What time should messages be sent?

- What messaging resonates best with them?

- How do they want to manage their debt?

When we apply a customer-focused lens, we can immediately see where risk scoring falls short and what it takes for granted.

Fewer channels, fewer opportunities

The success of any strategy relies heavily on the channels used. Lack of investment into digital results in fewer opportunities for communications to result in conversion (let alone liquidation). Call centres specifically present a greater risk with how live conversations can evolve, but agents can be more considered and planned when responding digitally. What’s also less considered is the wasted investment in the overuse of such expensive methods. The combined cost of direct mail, printing, postage and the operational costs of a call centre are huge when compared to the return on investment. However, tech stacks needed for effective digital communications are far more affordable, and scalable.

Limited options to resolve accounts prevents maximum recoveries and liquidation rates. To enable any strategy to have the maximum impact, we have to make it easy for customers to manage their debt, using the channels they already engage with. In practice this means omnichannel - a communications approach that ensures all preferences can be met, regardless of age, debt type or risk score. How do you cover all bases? Include both digital and voice platforms.

Lagging rate of change

While champion and challenger strategies introduce a faster rate of change compared to 20 years ago, it doesn’t quite cut it in an era where engagement preferences change rapidly. The key problem is that any adjustment to treatment strategy requires significant time - time to set up, time to implement and finally time to measure. To top it off, huge investment is made into making these small iterations and there’s no scope for adjusting in real-time.

The root of the problem? Measurement and tracking. Basic performance measurement such as liquidation rates can only be determined once a customer has decided to take action, but fails to unveil what led up to that action being taken, such as:

- Was the email / SMS opened?

- Were the links clicked?

- What time did they choose to engage?

- Did they look at the website? What pages did they look at? How long did they spend on those pages?

- Did they contact the Customer Service team? What was their query? How was their sentiment?

Answering these questions allows collectors to fill the gaps in the customer journey, which is pivotal in appreciating the push and pull factors to account resolution. In doing this, pain points can easily be seen, guiding where resources should be invested (as opposed to constant A/B testing). Looking at the collections cycle from this point of view can bring attention to areas of opportunity simply not exposed by the champion challenger model. For example, are customers contacting the Customer Service team after being sent an email because they need more information on how to set up a payment plan? The action here would be to add more information to the initial email template to reduce inbound calls, and shorten resolution time.

Consumers today expect responsive services that iterate continuously, matching the pace of surrounding industries. Unfortunately, when we align this rate of change to modern customer behaviour outlined in part one, you can quickly see the discrepancy.

Linear thinking

Customer journeys are no longer linear. The days of straightforward A, B, C engagement have long passed, and consumers now pass through as they choose. There’s research, engagement, more research, possibly a phone call, a conversation with a family member, and so on. The typical collections strategy today may use advanced modelling and enhanced understanding, but it’s applied to decades-old thinking. To really understand how collections can be successful in the context of today’s consumer, we have to do more than shift thinking in strategy development. We have to recreate it entirely.

Part three: The next generation in collections

Rethinking collections strategy as a whole means creating an entirely new solution. A solution that’s relevant for today’s consumer and how they engage. This principle in itself is new for the industry, putting customer needs and expectations at the centre of recoveries. In doing so you automatically make way for greater liquidation and conversion rates, as conscious effort is placed on maximising the outcome at every single touchpoint. So, what’s the solution? Intelligent collections.

How intelligent collections redesigns strategy

What is intelligent debt collection?

Intelligent debt collection represents an advancement in how debt collection should be practised, and the sophisticated technology that drives it. The term is synonymous with our product, Collect.

As a product and customer-led approach, the focus is placed on using data science to create a bespoke journey for every single customer. Marrying this with omnichannel communications, an industry-disrupting customer experience is designed - simply unachievable by traditional or digital collections.

To understand strategy in intelligent collections, let’s start with the basics.

Data science: The practice of using data to create actionable insights and implement intelligent processes.

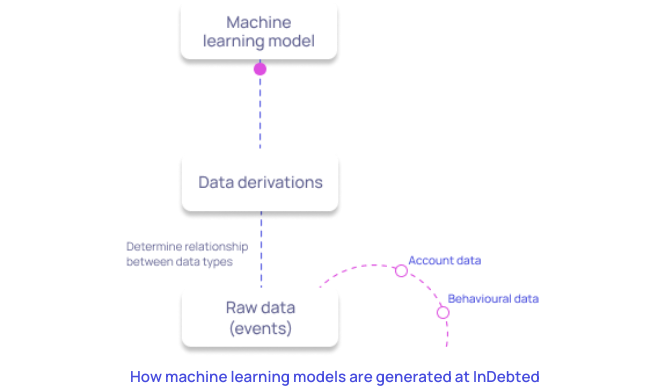

Machine learning: A form of data science, where algorithms are deployed to learn from data derivations, and the learnings are used to generate inferences for future use.

Behavioural data: Each interaction we have with our customers is recorded in our data warehouse. This may include data points which we can learn from, for example, when an email is opened by a customer following a particular message.

Data derivations: In the context at InDebted, this refers to the relationship between behavioural data and other account data, for example the propensity of a customer to be engaged given the following: message engaged + day/time engaged + debt type + customer demographics

Let’s say the following customer has been referred to Collect:

- David* (* fictional customer name)

- Account balance: $5,000

- Debt type: Personal loan

In standard collections, the account information would be entered into the scorecard, producing a risk score that would determine the 30-day treatment strategy for David.

In intelligent collections, his journey looks quite different:

See what customers experience with Collect- Immediately after Collect receives David’s account, his account data is matched with our proprietary behavioural and engagement data. By using data science, we know how people with the same attributes as David prefer to resolve their debt, and the best way of reaching him to do the same.

- Data science tells us the best time, channel, and message to engage David with his debt. This shapes how our machine learning models personalise each communication for him, using pre-tested, high-performing messages written by expert copywriters. Collect selects a unique email based entirely on David’s profile - with a tone matched to his engagement, optimised for his age and location, with information on how to create a payment plan.

- As for the best time to reach David - another machine learning model has been keeping track of the times and days that customers are most responsive across different channels, locations, and data points. It knows how to apply all of this at David’s convenience, maximising the opportunity for David to engage with his debt. This stage also incorporates our code-secured compliance, ensuring communications are all within jurisdictional regulations.

- How David interacts with every single communication informs what he’ll receive next, along with his self-serve customer App experience. Opens, clicks, App logins, page views, offer views, and any contact with our Customer Service team all feed into machine learning models built to be responsive to David’s every need, every step of the way.

Step 1. Harnessing data: Data warehouse

In linear collections, scorecards act as the central source of account data to guide strategy. These are fixed databases that only hold specific account information relevant to calculating a risk score.

With intelligent collections however, data is infinite. InDebted’s internal data warehouse holds over 300 million events which inform our machine learning models. This growing bank ensures that all models developed by InDebted are informed by real behaviours of those in debt.

Step 2. Personalised customer journey: Machine learning models and omnichannel engagement

The key difference between linear collections strategy and intelligent collections is the need to enforce a specific treatment to a targeted group. With Collect, strategy, treatment and measurement exist synonymously in our product, eliminating the need for scorecards, risk scoring or segmentation.

The personalised collections journey David receives is created by machine learning models. Collect uses multiple models to personalise targeted elements of a customer’s journey, from the time they receive an email to the message they’re sent. These models are generated from raw customer data such as:

- Account: Outstanding balance, days past due, type of debt

- Behavioural: Previous customer engagements such as email opens, SMS clicks, scrolls on key pages

Once the model has received the raw data, it determines the relationships between the different data types, and produces data derivations. These are actionable insights that are fed directly into Collect. All data derivations produced are unique and owned by InDebted, as they incorporate historical data from over 2.5 million customers worldwide.

Machine learning model in practice: Message scheduler

This particular machine learning model uses data derivations which predict the optimal email send time according to the specific characteristics and behaviours of an individual customer.

Once the model has assessed the profile and behaviour of an individual customer and produced an optimal send time, it simply feeds this information directly into Collect. The product will then automatically contact the customer at their personalised email send times, optimising the likelihood of conversion for every message sent. This seamless integration between our machine learning models and Collect means that utilising data insights is effortless; establishing automated intelligence.

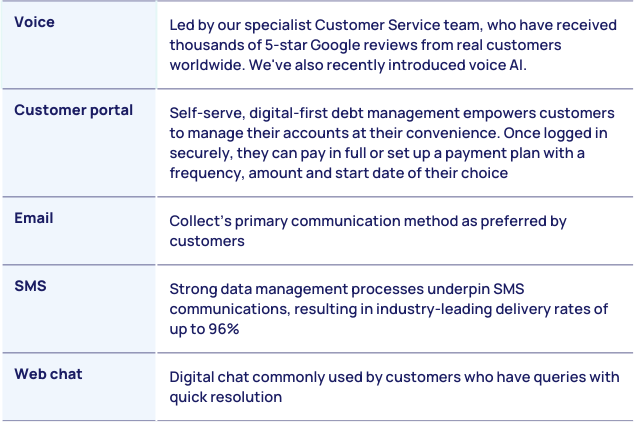

Omnichannel engagement

As with risk-based strategies, success is dependent on the communication channels used. To be truly responsive to the channels people prefer on an individual level, Collect uses an omnichannel approach. It’s digital-first, recognising the widespread preference for digital engagement. However, it’s intuitive nature means that voice channels are still open to customers. It’s about providing choice for them to engage with their debt in a way that works best for them, through two-way communication across:

Step 3. Real-time improvements

Linear strategies require 30-days minimum to identify areas of improvement, using the champion and challenger model. In intelligent collections, improvement is continuous.

Due to the very nature of data science, as more customers are referred to Collect, the machine learning models are continuously shaped by new data and learn to produce even more precise recommendations. This means that as InDebted’s warehouse builds, so does the intelligence of our models and in turn, the success of their engagement.

When it comes to measuring performance, intelligent collections enables businesses to understand customers on a far deeper level, on top of core recovery metrics. Businesses are able to see how accounts are tracking in real-time, and gain rich insight into who their customers are and how they engage with debt. This gives the upper hand, placing teams in a stronger position to be responsive to changing customer needs - a position that can’t be underestimated in a landscape where customer behaviour is constantly evolving.

A future-proof strategy

Optimal recovery performance can no longer be achieved by treatment models that operate within the boundaries of risk-scoring or traditional communication methods. To create a strategy that’s fit for 2024 and beyond we need to shift our mindset.

Intelligent collections changes the narrative on debt, to empower individuals to pay it back faster, proactively and more sustainably. It allows data to dictate the strategy, ensuring that collections activity is consistently aligned with how customers want to engage with their debt - regardless of their account or behaviours. Rejecting the blanket approach, it recognises the need to tailor customer journeys to every individual to unlock recovery potential.

Crucially, it removes the heavy lifting. Integrating data directly into Collect creates a symbiotic relationship between the two. With engagement tested and analysed in real-time, it enables the product to learn as new information is fed in, giving rise to automated intelligence. At the same time this makes sure that teams can focus on initiatives that truly require the human touch.

The result? A future-proof collections strategy that can meet your customers needs today, and tomorrow.

Join our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.Stop losing subscribers: the proven revenue recovery strategy that turns churn into retention

Involuntary churn is costing subscription businesses loyal customers and revenue. Recover missed payments and reduce churn with an alternative approach.