Our collections insights over tax season, and what you can do to prepare now

Featuring Dan Simmons - Senior Director Financial Consulting, TransUnion

Tax season. Two words that are marked in red on every creditor and collection agency’s calendar. We know what you’re thinking - there’s still a few months left to prepare, right? This year, almost half of US taxpayers plan to file their returns on or before February, and 1 in 3 plan to spend their tax refund on resolving an overdue account.

To be front of mind for consumers as the returns start to come through, it’s vital to start preparing your collections now. We sat down with Dan Simmons, Senior Director of Financial Consulting at TransUnion to explore the top four areas to focus on to get your collections ready, and make the most out of the upcoming deadline.

1. Frontload your collections

Timing is everything.

Dan emphasised that by referring accounts earlier to your third-party collections partner, you get a head start on maximising every opportunity for prompt contact, using a combination of digital and non-digital channels. This will help your customers prepare, ensuring that clearing any payments owed is high on the priority list if they receive a refund. An omnichannel strategy is key to ensuring that customers are contacted through the channels they prefer, optimizing their experience and conversion rates.

As tax refunds start to trickle out, our collections data shows a peak in payments in full between January and February which rose by 82.4% in 2022 and 77.5% in 2023. Whether these spikes in clearing accounts in full comes as a result of early tax refunds or financial gifts over the holiday season, the influx shows consumers are keen to get back on their feet in the New Year.

2. Provide flexible repayment options to support more customers to get back on track

Consumers have been feeling the pressure this year. In our recent Better Debt episode, Dan explored how the United States may have escaped a recession but sustained inflation rates have had a knock on effect - reduced personal savings, higher delinquencies and tighter budgets.

When it comes to supporting a stretched population with less to fall back on, providing flexible repayment options is a must. This means giving customers flexible options to resolve their accounts rather than the standard ‘pay in full’, such as:

- Customisable payment plans where the customer can choose the start date, instalment amount and frequency of the plan

- The ability to make one-off payments at an amount of their choosing if they receive a tax refund or have additional savings one month

- Discount settlement offers for those larger, harder to move accounts

At InDebted, we’ve seen the growing trend towards flexible payments reflected in collections data over tax season. Between February and March in 2022 and 2023, there was an average increase of 13% in new payment plans. Particularly for consumers who need to split their tax refund across various priorities, or receive a smaller amount than expected ( as in 2022), dynamic repayment options offer a sustainable solution.

3. Focus on enhancing the customer experience at a time where consumer pressure is high

Unfortunately, elevated consumer pressure goes hand in hand with lower sentiment levels. The University of Michigan carries out a monthly survey to find out how US adults are feeling about their personal finances, the state of the economy and business conditions. The metric fell by 4% between October and November 2023, showing that consumers are feeling less optimistic - as they’re experiencing the weight of high prices.

How should this be applied to collections? At a time where customers are more financially strained, a collections experience that feels pressuring and shaming is an immediate turn-off. To flip the script it’s important to appreciate the challenges and pressures they’re likely to be facing. This means revisiting Customer Service training to hone in on empathy-building , ensuring messages are engaging and supportive, and including pathways to additional support.

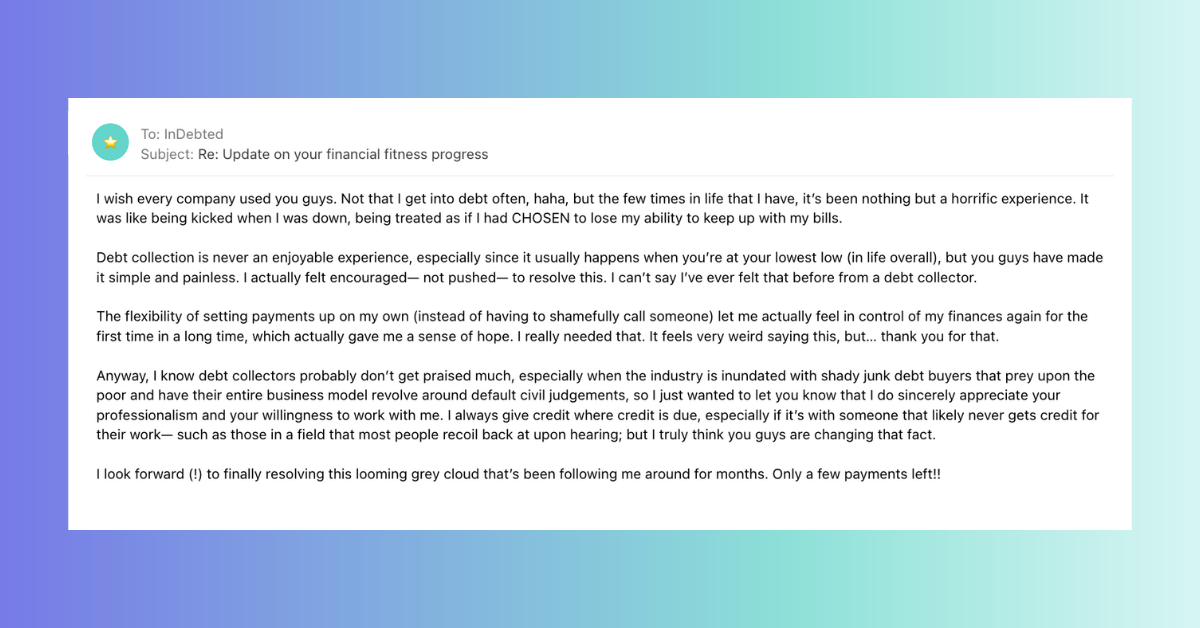

Achieving high customer satisfaction levels creates a domino effect. Customers feel empowered on their collections journey, manage their debt in a way that suits them best, and retain a positive brand association with their originating creditor. It’s a win-win, for all parties involved. This review left by a customer referred to InDebted says it best:

4. Leverage collections technology to make data-informed decisions

As Dan says, it’s no secret that delinquencies have been creeping up and it’s likely that they’ll continue to rise post-holiday season. To manage an influx of accounts while providing an optimal customer experience, using a data-driven and scalable collections partner is like having an ace up your sleeve.

By leveraging a technology-led provider with data informed decision-making, you’ll gain a deeper insight into your customers, particularly into areas such as seasonality, trends and preferences. Take your use of collections technology one step further by looking for a partner who leverages machine learning, to predict personalized experiences for every single customer, based on their individual preferences and behaviour.

In the long run, partnering with a digital-first, technology led collections partner gives your business a superior level of confidence. Not only are your customers given the ultimate collections experience, but the very nature of data science means that those experiences will become even more refined over time. Even better - in a complicated regulatory environment, advanced collections products have compliance built directly in by code, shielding you from any breaches.

Strengthen collections for more than tax season

Optimizing your collections for the upcoming tax season shouldn’t be carried out in isolation. By investing in long-term initiatives that elevate your existing strategy, you’ll be able to ensure your collections continue to achieve high performance results, regardless of external pressures. The magic in the steps above is that they can (and should) be considered in the context of your bigger picture and overall strategy, enabling you to make the most of the tax deadline - and beyond.

Join our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.Stop losing subscribers: the proven revenue recovery strategy that turns churn into retention

Involuntary churn is costing subscription businesses loyal customers and revenue. Recover missed payments and reduce churn with an alternative approach.