Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.

Better Debt

Bringing together all corners of collections to share market insights and new perspectives, Better Debt shines a light on advancement and innovation in our industry. Watch past recordings or see future events to join the conversation live

Innovating and diversifying your collections panel

Diversifying your collections operation can improve customer experience, minimise risk and innovate your collections. Everything you need to know about finding the right partner, driving performance and comparing vendors in the latest episode of Better Debt. With Josh, Tracy & Justin

Scalability & resilience: Setting your collections up for success with CPS230

Preparing for APRA's new CPS230 standards in time for the July deadline is front of mind for financial services. Hear the key themes from our experts and exactly what they mean for your collections. With Josh, David & Poli

AI and Machine Learning Masterclass

Where do you start with implementing AI in Financial Services? Uncover everything you need to know straight from the experts, in this essential Masterclass. With Jo, Duhita, Josh & MikeOur Collections insights

Guides, resources and data you can use to take your collections to the next level

5 expert-backed tips for working with multiple collection agencies

Diversifying your collections panel can be a game changer for your organisation.AI debt collection vs. traditional methods: what's different?

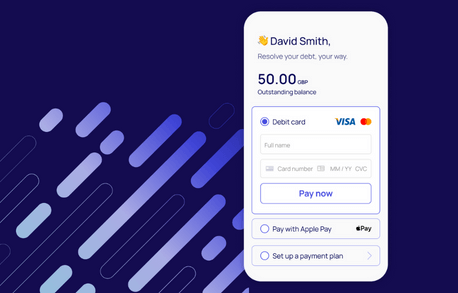

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.Client stories

Read our Client Success stories and discover why InDebted is the collections partner for leading organisations

Product blog

Keeping you in the loop with our product releases, performance updates, and future plans

Google and Yahoo spam updates: How we achieved a spam rate of 0.2%

Collections emails impacted by new spam requirements? See exactly how we achieved a user-reported spam rate of 0.2%.How we use AI to increase email payments by 32%

Collections communications not landing with customers? See how AI-written collections emails increase payment conversions by 32%.The ins and outs of our Product Roadmap

Get the inside scoop on what's in store for our product, Collect this year.Newsroom

Stay on top of our big news, announcements and recent media coverage

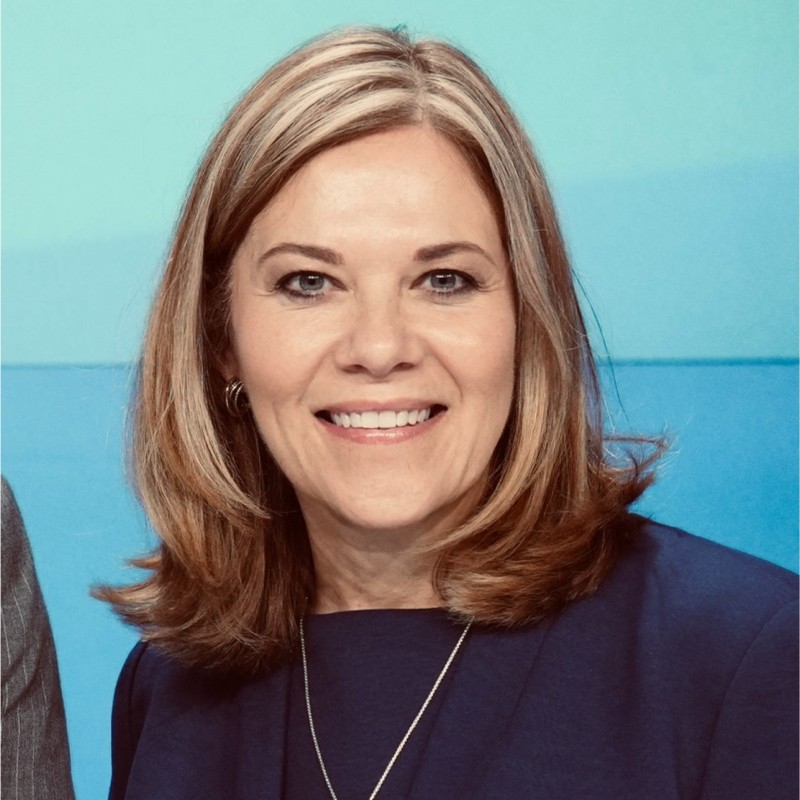

Strengthening our Legal, Risk and Compliance function

We’re proud to have not just one, but two highly regarded leaders in the Risk, Compliance & Legal remit at InDebted. Laura White has joined InDebted as Chief Risk and Compliance Officer, while Tim Collins has been appointed as General Counsel.

InDebted completes acquisition of Reminda, reigniting global M&A strategy

InDebted has announced the completion of its agreement to acquire Reminda, a leading debt collection agency headquartered in Sydney.

InDebted launches into the UK, finding that 2 in 3 Brits dealing with existing debt collectors experience “stressful” treatment

Read findings from new research that highlights the impact of the broken debt collection industry in the UK on consumersInside InDebted

Stories about our team, culture, and purpose to change the world of consumer debt collection for good

How we built a 5-star Customer Experience team

Traditional debt collection isn’t renowned for a great customer experience, but at InDebted it’s core to what we do.Changing the debt collection industry for good, one positive experience at a time

Read why 2,000 customers rate InDebted as the top collections agency in the worldReflecting on 20 years in the collections industry and embracing a new chapter

With almost two decades of experience, read Tracy Glen’s reflections on her time in collections and where the industry is headed