How to maximise your dunning processes

No one wants to lose loyal customers, but churn can be a bottleneck for every subscription business.

With 27% of consumers saying they’d cancel their subscription if their payment doesn’t go through, rehabilitating customers couldn’t be more time sensitive. What’s more is that on average, SaaS and subscription businesses lose 9% of their annual revenue to failed payments.

So what can you do?

Enter, dunning. It’s likely that you already have some dunning practices in place. But, how effective are they at reducing customer churn? Let’s unpack how top subscription businesses implement dunning and how it contributes to your overall financial strategy.

What exactly is dunning?

Dunning is processes that businesses use to recover failed or outstanding payments from their customers.

Think of it as any in-house efforts to recover payments that are due or past-due. This could include technical processes such as payment processor updates, or an automatic email sequence.

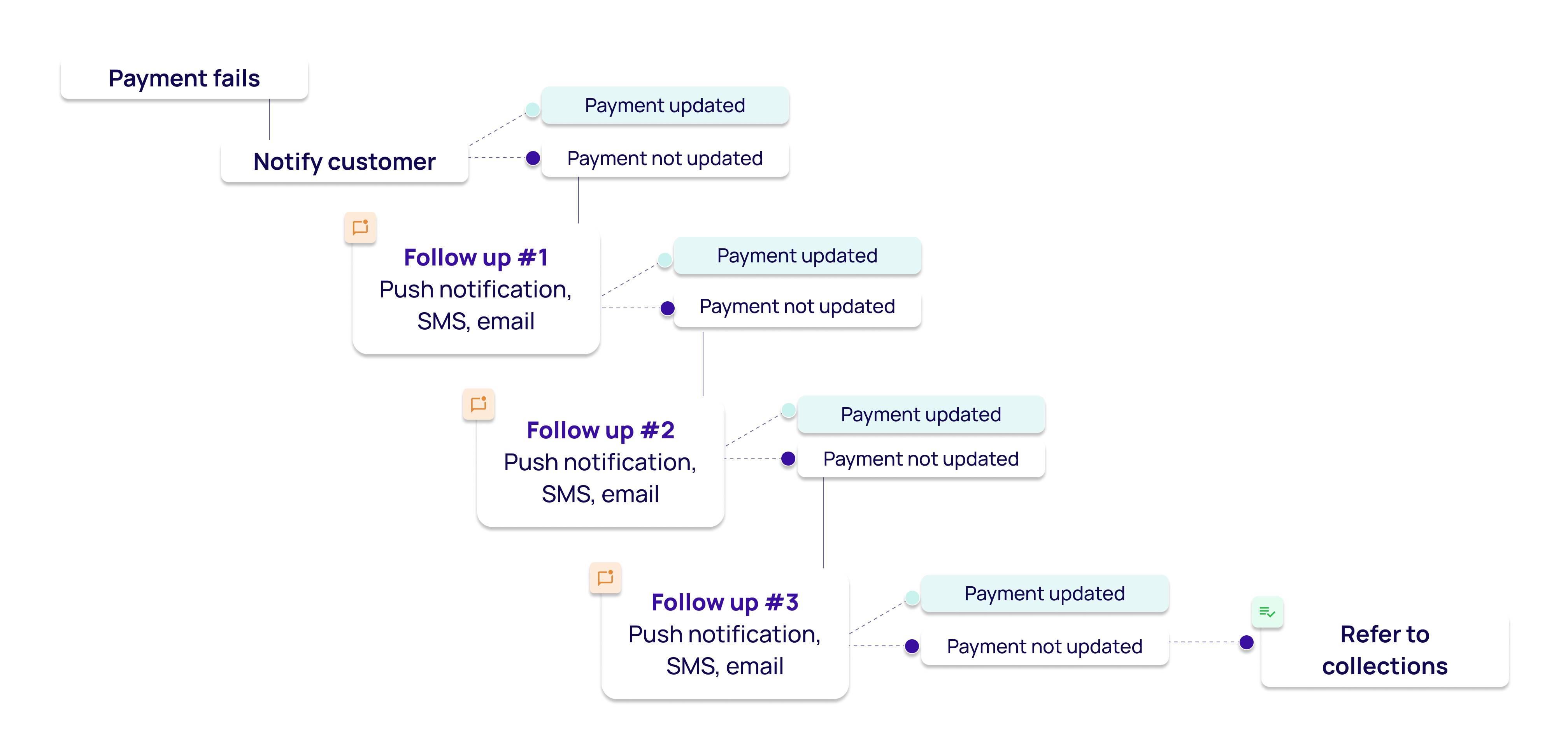

An effective dunning strategy could look like this:

Typically, dunning strategies are designed to last ~60 days. It’s a short window, as businesses often don’t have the capacity to maintain ongoing dunning efforts. If an account hits this point, it’s either be written-off or referred to a collections partner.

Gold standard dunning practices

Similar to debt collection, dunning doesn’t exactly have the best reputation. Historically, this has been because of the way tactics are implemented, for example harsh emails, repeated phone calls - you get the idea.

So how do you create a dunning strategy that doesn’t scar your customers, but still recovers those all-important overdue payments? Here’s how leading subscription companies do it:

Keeping an eye on the important numbers

The metrics you track are a major determinant of how successful your dunning practices are. Customer churn is critical to keep an eye on, with 20% of subscription businesses viewing it as the most important. Others to consider are:

- Customer lifetime value (CLV): the total amount someone spends with your business, throughout their lifetime as a customer.

- Customer retention rate: the rate at which customers stay with a business, in a given period of time.

- Average customer lifespan: the average number of days between the first and last order date of all of your customers.

1 in 3 subscription companies also track payment recovery rate, with leading businesses recovering 60% of failed payments. It’s a reliable barometer for how your dunning strategy is performing, and whether adjustments are needed.

For dunning specifically, look closely at your failed payments. Top subscription companies are 6 times more likely to do this than lower-performing subscription companies. But why? It allows you to see how failed payments are impacting your CLV, and provides actionable insights into why payments are failing.

Sharpening software setup and automations

This is where your Product and Engineering teams come in, to ensure your platform minimises failed payments at every opportunity. The tighter your infrastructure, the less likely it is that failed payments mature into your write-off portfolio. Best technical dunning practices include:

- Dynamic payment routing: Looks for the fastest and most efficient way to process payments, reducing the likelihood of them failing. It requires heavy lifting from your Product team to set up the correct infrastructure.

- Payments “cycling”: The process of retrying payments using other payment methods already on file. If you have this in your terms and conditions, optimise your retry acceptance rate and cycle another method of payment? Heads up, this can also be a large undertaking for Product teams.

- Payments retry strategy: Financial institutions differ in every market, based on varying baking hours, payment types and more. Your strategy needs to be optimised for their processes, calling for a close link between your Product, Legal & Finance teams.

- Awareness of card issuer limitations: It’s no secret that issuers have made it increasingly difficult (and expensive) for merchants to recover payments. The myriad of fees for “excessive retry” or decline codes suggesting “do not retry” pack a hefty price tag for each initiated payment. This can damage your reputation in the eyes of the issuing banks and cause a snowball effect for increasing declines.

- Regular payment processor reviews: Software processing issues are the top reason for failed payments, so correcting any unforeseen problems is key. For example, what payment types does your processor accept? Or is it checking that the billing and shipping address match qualification? These seemingly small features can be the difference between a customer retained, and a customer churned.

Friendly, well-timed communications

If failed payments persist, carefully considered customer communications come next. To optimise the likelihood of customers not only resolving their balance, but returning to your brand, keep your dunning messages:

- Friendly and clear: The days of aggressive messages are well and truly over. This approach can go a long way in harming your customer relationships and your brand. Leading companies keep their communications friendly and compassionate, so customers know that they’re supported. Be sure to include clear instructions and easy links to repayment methods, making it as simple as possible for them to get back on track.

- Well-timed: With a tight window, communication cadence needs to be carefully constructed. Strike the balance between being front of mind for your customers, but not overloading them with daily emails. A/B test different patterns to see which hits the mark, comparing payment recovery rate and customer lifetime value.

- Multi-channel: What channel do you use to communicate with your customers, is it mostly email or SMS? Do you have in-app notifications, or an online portal? Optimising your dunning communications means looking at the customer channels you have available. If a customer rarely checks their email, an in-app notification or an SMS makes much more sense. Think about your broader customer journey, as dunning messages need to align with your bigger picture.

Leading subscription providers also leverage other tactics such as customer incentives and grace periods. These extra sweeteners automatically strengthen a customer’s relationship with your brand and in turn, your retention rate.

Dunning is one part of the puzzle, not the entire picture

What happens if you implement all the above, but failed payments still occur? How you consider your bigger picture is what sets leading providers apart. See dunning as one phase of your failed payments lifecycle. If these internal efforts are unsuccessful, the next phase becomes increasingly important.

Almost 1 in 2 top subscription companies work with a third-party collections provider, to recover their outstanding payments. Compared to less than 1 in 20 low performing providers, it’s an obvious differentiator. With a partner that truly prioritises your customer relationships, collections can reduce your write-off portfolio and extend your retention rate.

Perfecting your dunning process is an ongoing effort. At its core, your tactics need to stay integrated, friendly and timely to get the best outcomes for your business and customers. But the secret is to appreciate dunning as one part of the puzzle, not the entire picture. Weaving it into your broader financial strategy is what will make your customer relationships and revenue even stronger.

Learn more

Join our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

5 expert-backed tips for working with multiple collection agencies

Diversifying your collections panel can be a game changer for your organisation.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.The state of financial wellbeing in Australia, the United Kingdom and the United States, and how collections can support

How are your consumers coping financially? See the state of financial wellbeing across key markets, featuring the latest insights and practical actions for supporting stretched customers.