5 reasons digital debt collection improves collections performance

Now more than ever, brands are investing in digital. In 2022, 87% of organisations increased their digital engagement investment - even in a challenging economic landscape. But what’s the return? Well, those leading the way in their digital strategy with initiatives such as personalisation, use of first-party data and omnichannel engagement saw increases in revenue by an average of 90%.

We’ve found that by communicating with customers over digital channels, rather than a traditional-only strategy such as calling and sending letters, collections performance increases by 40%. If that’s not enough to convince you, here’s some more reasons on why it’s time to shift to digital.

What’s the gold standard of digital debt collection?

Before we jump in, let’s define the gold standard of digital collections.

- Offering self-serve capabilities, enabling customers to resolve their account without agent interaction.

- Ensuring digital collections is omnichannel, using a variety of digital and

- voice channels to communicate with a seamless journey.

At its core, digital collections is all about convenience. This involves communicating with customers to enable them to manage their account in their own time, through their channel of choice, and to easily access support if they need it.

1. Meet modern consumer expectations

Think about the last time you made a bank account transfer. Did you call your bank or did you transfer using your bank’s app? If your answer was the latter, you’re among the 78% of consumers who use a mobile when interacting with an organisation - this increases to 90% for millennials. It’s about meeting customers where they’re at, and in 2024, that’s primarily online.

What’s more, 74% say that they expect to be able to do the same things online, as they can over the phone. Consumers don’t just want ease and convenience, they expect the same capabilities across channels. As an example, let’s look at the following customer, who had a simple query and decided to use InDebted’s online chat to reach out:

“Amazing service, great online chat tool that resolved my issue straight away. I talked to Isabel and she explained things very clearly and made it easy to understand what I needed to do on my end. She deserves 5-stars and is a great representation of the company” - 5-star customer Google review, Dec 2023

2. Provide more ways for customers to pay

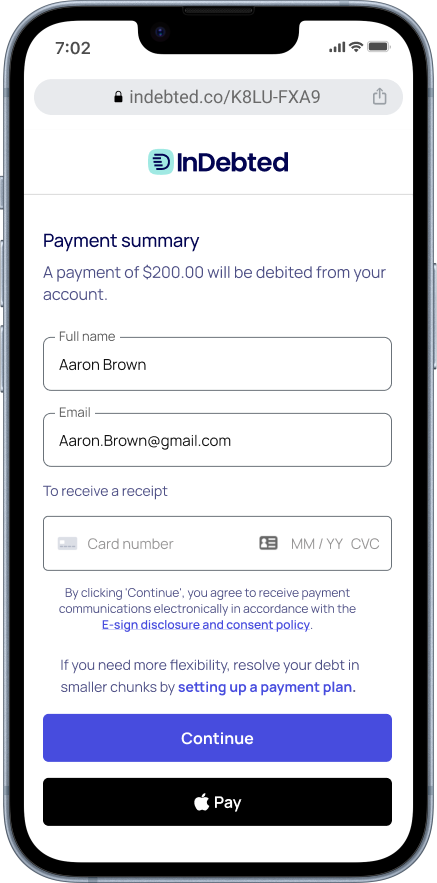

Digital wallets such as Apple Pay and Google Pay are fast becoming the number one choice. Over in 1 in 2 use these services more often than traditional payment methods. Going even further, 51% say that they would stop using a brand that doesn’t accept digital wallets. The simplicity of using a face ID, fingerprint or passcode without the need to remember long card numbers or expiry dates is a game changer. Enabling these services is emerging as an expectation for customers across the world.

Our own data shows that when assessed against other payment methods, customers choosing Apple Pay have the highest conversion rate of 93.3% compared to all other payment types. Digital wallets provide a seamless and frictionless journey, enabling your customers to get their accounts back on track faster.

3. Create convenience with self-serve

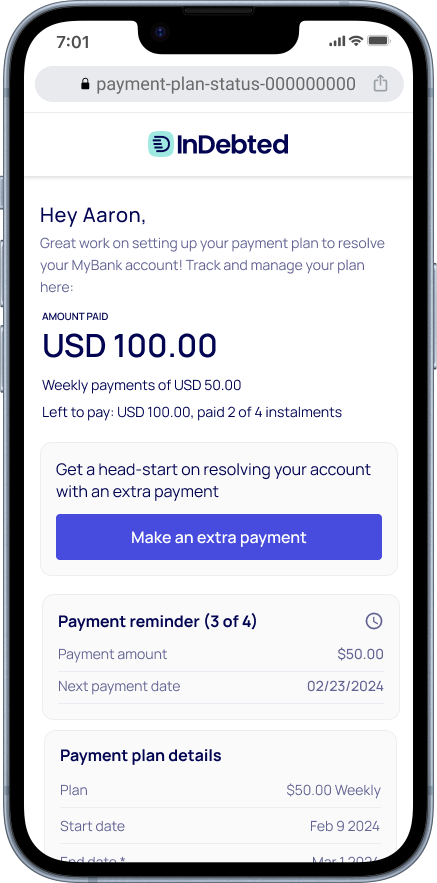

80% of customers who get back on track with InDebted manage their account entirely independently using our portal. If you had to choose between going back and forth with a Customer Service representative or managing your account on your own time, it’s a no brainer. The nuance here is the capability of self-serve. Sophisticated digital collections will have an advanced self-serve offering that enables customers to:

- Pay their entire balance in full if it’s affordable

- Make one off payments as they choose

- Set up a customisable payment plan with an instalment amount, frequency and start date of their choice

- Check any upcoming payments, with a clear overview of their payment plan schedule

Collect’s customer portal provides a complete self-serve solution

It’s about more than providing a way for customers to pay - they need a holistic solution that puts the power back in their hands to manage their accounts themselves.

4. Pave the way to personalisation

66% of consumers say they would stop using a brand if their experience isn’t personalised. But how do you create a personalised experience in debt collection to really hit the mark with customers?

Communicating through digital channels is one thing, but personalising that communication is another. This requires machine learning to apply data-driven insights to every single customer experience. Using this technology, you can craft each customer touchpoint around their previous engagement to maximise conversion rates every step of the way. This includes:

- Sending email communications at the time a customer is most likely to engage. Our own email scheduler machine learning model has increased payment conversion rates by 20%!

- Predicting which message will best engage that customer to take action on their account can raise email conversions by 7%, and click rates by 5.4% - proven by our message recommender model.

- Targeting every communication to where a customer is in their collections journey maximises channel conversions. Looking at our Customer Journey machine learning model, it increases email conversions by 7.32% and SMS conversions by an even greater 11%.

This level of personalisation is core to intelligent debt collection, which is a step beyond digital debt collection. Its use of machine learning means that every customer journey is responsive. How they interact with a previous communication informs what, when and how their next communication will be sent next. The best part? Machine learning models do exactly that, they learn with each interaction to improve predictability in real time.

5. Fast improvements and enhancements

Starting with digital advancements, innovation in the collections industry is growing at a steady pace. It’s enabling collection providers to be more data-informed, which creates better visibility into improvement opportunities. This opens the door to providing a better customer experience, and with this comes better results. This includes:

- Testing a variety of communications at a faster rate to determine which resonate better with customers

- Introducing new channels, for example, live chat

- Adding additional language capabilities to support more customers in their preferred language

- Implementing new features to customer portals

Any digital collections provider should have a clear roadmap of upcoming digital projects, demonstrating an appetite for constant improvement. Take our Collect product, which deploys new features and enhancements continuously with over 7,400 platform builds in 2023 alone. What’s obvious is that consumer expectations are constantly evolving, and collections must adapt accordingly.

Digital is a tool, intelligence as the ultimate solution

Meeting customer expectations is impossible without digital channels, for all the reasons above and more. However, the secret to unlocking full liquidation potential lies in leveraging collections intelligence. Taking collections rates to new heights, it drives digital collections to the next level.

Learn more about intelligent collectionsJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

Is debt collection right for your subscription business? Weigh up these pros and cons.

Sending your subscribers to collections? We answer your most commonly asked questions here.5 reasons why leading subscription businesses partner with InDebted

InDebted is the trusted solution with five-star reviews, industry-leading performance, flexible payments, self-serve and personalisation that keeps your subscribers happy.The revenue impact of failed subscription payments — and how to recover it

The hidden costs of unpaid subscriptions may be doing more damage to your subscription business than you think.Stop losing subscribers: the proven revenue recovery strategy that turns churn into retention

Involuntary churn is costing subscription businesses loyal customers and revenue. Recover missed payments and reduce churn with an alternative approach.