Why the future of debt collection is digital-first and customer-led

Nowadays, most consumer transactions take place online. To ensure collections don’t get left behind, collectors need to adopt a digital-first approach and meet the needs of a modern consumer base.

How will intelligent debt collection benefit your business?

While a digital-first approach is designed to provide more help to consumers with overdue accounts, clients reap the rewards. When considering collections agencies, there are three important metrics to judge prospective partners on: commercial, customer experience and compliance.

Create a loyal customer base

Happy customers are more likely to stay with their existing organisation. Digital-first collectors provide customers with better experiences because of the frictionless contact and the ability to self-serve.

A digital end-to-end approach, such as InDebted’s, allows consumers to resolve their account online, chat with a customer service team 24/7, pay in instalments, or resolve a debt in full. This ease of use has a positive effect on the brand and reputation of the company who is owed the debt. Because of the positive experience, once the customer is back on track financially, they are more likely to stay as a customer of your business as opposed to going elsewhere.

Boost your commercial outcomes with higher recovery rates

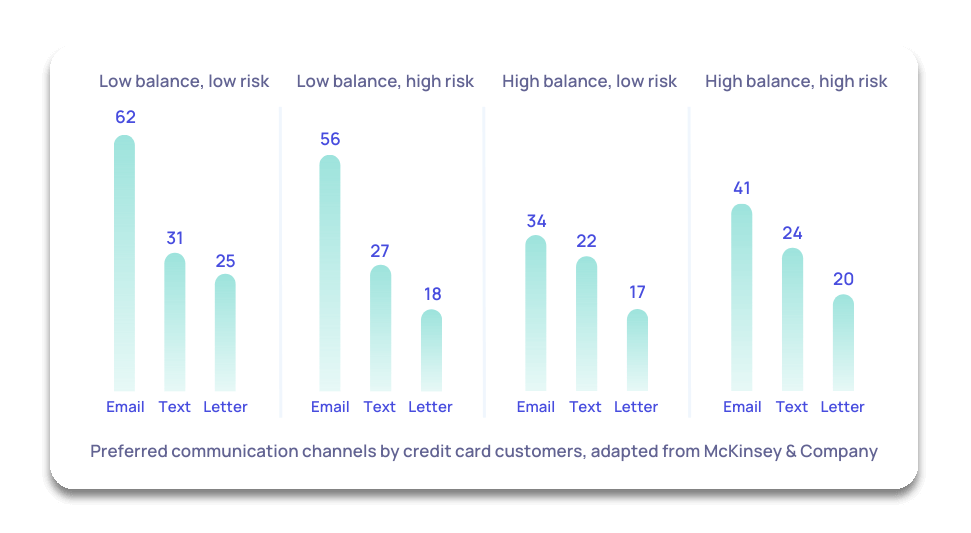

From a commercial point of view, using a modern collection agency results in higher recovery rates for a business. Statistics from McKinsey & Co show contacting customers through preferred digital channels improves effectiveness, especially in the 30-plus days past-due segment.

“There’s a tendency for clients to think digital is the cheaper option, and one that you use to save some money before going back to the traditional style of debt collection,” Josh Foreman, CEO InDebted says. “But we’ve proven our intelligent approach outperforms traditional methods, works on all types of accounts and at all stages of the process. Fundamentally, debt collection is not about trying to save costs, it’s about implementing efficiencies that allow you to recover more.”

Mitigate compliance risks

Meeting compliance requirements is one of the major benefits to clients of intelligent debt collection. Financial institutions are more cautious these days about how they deal with their customers’ debt. Most of the risks introduced in debt collection are process or people risks, for example, not sending a notice that a person was legally required to receive, or a call centre operator saying something on the phone they weren’t meant to. Technology is far superior in terms of dealing with these issues as failsafe codes can be built-in directly, to prevent them occurring.

Larger organisations tend to have legacy systems that make meeting the levels of required compliance difficult. This is when outsourcing to a modern collection agency is the most effective solution, as their systems have built-in protections against process risk.

Intelligent debt collection also overcomes the people-risk in maintaining compliance. By being digital end-to-end, consumers have more opportunities to self-serve, reducing the need to have real-life conversations. Fewer conversations minimises the risk of call centre agents providing incorrect information or having negative customer interactions.

Another way intelligent debt collection mitigates compliance risk is through offering a more robust and automated compliance infrastructure. “The right technology and the right way of incentivising people is what really minimises risk,” Foreman says. “Compliance is the benchmark our clients look for, and then customer experience. The commercial element is the final component. Intelligent debt collection ticks all three of those boxes.”

How intelligent collections delivers exceptional customer experience and maintains compliance

All organisations want to provide exceptional customer service, but how is this defined in debt collection? To InDebted’s Chief Compliance Officer, Tim Collins it involves, “giving your customers all the information they need to self-serve through the channel of their choice, 24/7, every day of the year.”

But with debt collection comes compliance obligations, especially around what regulators require of organisations. “This is the point where a lot of collection agencies stop,” Collins says. “This is where they say they’re only going to do the bare regulatory minimum that’s required.”

Taking the extra step to a customer-focused approach

But according to Collins, this attitude means opportunities are missed, because if businesses do go a step further, they become more customer-focused and reap the resulting benefits.

“When a business is focused on what’s good for their customer, they don’t get the same level of complaints from them or from the regulators about their business practices,” he says. “It also leads to fewer issues. We’ve become a very litigious society and the practice of calling consumers all the time is now frowned upon by regulators with many issuing guidelines around what is acceptable.”

Collins says compliance issues also tend to arise for organisations when their debt collection agency relies on call centre staff reading the same prepared script to consumers. This is because human nature dictates that mistakes will be made, possibly with legal consequences.

“InDebted’s approach is to put as much as possible into the product, Collect,” he says. “For example, the messages that we send are checked at multiple levels to make sure that they’re going out at the right time and the content has been approved for that customer’s specific location. This approach allows us to build controls right into our platform and this helps avoid compliance errors.”

Another contributing factor towards customer satisfaction is that with intelligent debt collection, information can be seamlessly transferred across multiple channels. “One of the most common complaints businesses receive from their customers is that they have to repeatedly verify personal information each time they are passed to a different person,” Collins says. “But with intelligent debt collection, that constant verification isn’t required. Combine this with being able to make a payment using the channel they want, whenever they want, and businesses are able to offer exceptional customer service with no compliance breaches.”

The role of regulatory bodies

Regulatory bodies aim to prevent harassment, threats and deception when it comes to debt collection but the basic principle they champion is to treat people fairly.

“Few regulatory bodies define exactly what that means, and none tell you what you can do,” InDebted’s Tim Collins says. “In the US, a debt collection agency cannot keep ringing a consumer who doesn’t answer, as that is deemed harassment. But the regulator doesn’t tell you whether you can call on Monday, and if they don’t hear from the consumer, whether they can then call the next day. They don’t go into that level of detail.”

Few regulators around the world have contemplated what digital compliance looks like or should look like, Collins says. But the companies that are going to be successful in the digital debt collection space are those that “think like a consumer and act like a consumer”.

“This is because consumer empowerment is the number one change that’s happening,” he says. “Consumers increasingly prefer to deal with those companies that have an easy-to-use payment portal where they can conduct all their business.”

Speak with salesJoin our newsletter for the latest collections insights

Thank you for subscribing!

Join our newsletter for the latest collections insights

Thank you for subscribing!

Share

Other resources

5 expert-backed tips for working with multiple collection agencies

Diversifying your collections panel can be a game changer for your organisation.AI debt collection vs. traditional methods: what's different?

While traditional debt collection is increasingly seen as out of touch, a new generation solution is disrupting the landscape — AI-powered debt collection. It puts the power back into customer’s hands, to manage their debt their way.Improving collections strategy by 30% with machine learning

Contacting customers digitally to recover overdue accounts is one way to improve your customer experience. But predicting how each customer prefers to engage, and adapting each step of their journey accordingly takes your collections to entirely new levels of personalisation.The state of financial wellbeing in Australia, the United Kingdom and the United States, and how collections can support

How are your consumers coping financially? See the state of financial wellbeing across key markets, featuring the latest insights and practical actions for supporting stretched customers.