How a digital-first, omnichannel debt collection strategy performs with post-charge off accounts

There’s a misconception that the older the debt, the harder it is to recover. While post-charge off accounts have more unique characteristics than newer, more recently overdue balances; what if the problem isn’t the age of the debt, but the strategy itself?

Here’s our insights from our partnership with large United States debt buyers. We’ll dive into our collections performance across different characteristics, channels and even balance sizes to understand the impact a digital-first, omnichannel collections strategy has on post-charge off recoveries.

Client profile

This debt buyer purchases or services receivables portfolios from major banks, credit unions and utility providers.

Before the accounts enter our product’s ecosystem, they’ve been through 1-3 collections cycles. By the time they’re referred our way, they’re anywhere up to 600 days past due. Over the last two quarters, 500,000 accounts were referred to InDebted, mostly originating from credit cards and personal loans.

How do different age groups engage with digital channels?

We’ve all heard that “older demographics won’t engage with digital channels”, right? Wrong.

Engagement rates

While the majority of this debt buyers’ customers referred to InDebted are younger than 40, the click through rate on emails are consistently high within customers aged between 46 and 60. Our data shows that there’s only a 0.1% difference in engagement between Millennials (aged 27-42) and Baby Boomers (aged 59-68).

This shows that digital communication is a valuable collections channel, particularly for older age groups. The idea that older customers will only engage over the phone isn’t necessarily the case.

Payment preferences

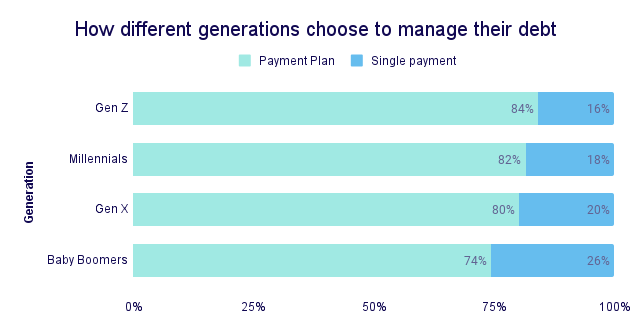

Here’s where generational differences start to emerge.

- While payment plans are the preferred choice across all demographics, a greater proportion of older customers opt to resolve their debt with one payment in full than younger generations

- 84% of Gen Z customers (aged 18-26) go for payment plans, compared to 74% of baby boomers.

From these insights, it’s clear that payment plans are a strong avenue to support consumers to pay back their debt in a way that works for them - and this rings particularly true for post charge off accounts.

There’s also a clear increase by generation in the affordability to pay in full. From this, we can hypothesise that older generations have different spending habits, more money in savings, or just generally extra room in their budget, making clearing their debt in a single payment a viable option for them.

The key takeaway is that paying debt looks different for everyone - and shifting typically ‘hard to move’ accounts requires options, and flexibility.

What about different balance sizes?

Engagement rates

While you could expect to see a decline in engagement as the balance size increases, in fact, click through rates remain stable for accounts over $501 up to $1000, changing by a fraction at just 0.11%.

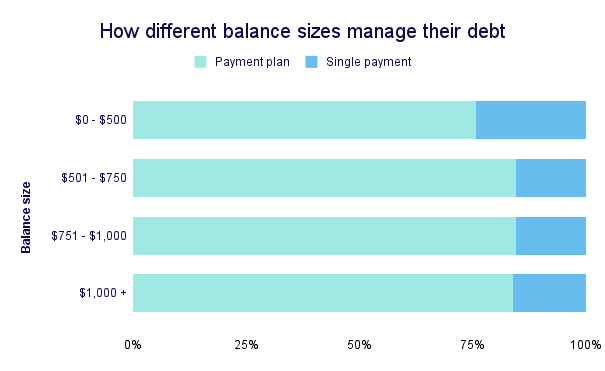

Payment preferences by balance

This is where flexible payment options really shine. There’s an overwhelming preference for payment plans for consumers with balances over $501, with over 4 in 5 choosing this option. In 2022 the Consumer Financial Protection Bureau found that 24% of Americans don’t have emergency savings, reinforcing the need for flexibility in paying back debt. For those with a large overdue balance and no financial cushion to fall back on, a customizable plan is a safer, more sustainable way forward than a single payment.

Are there any trends in payment plan frequencies and durations?

We’ve established that payment plans are key in post-charge off collections - but let’s dig deeper into how these payment plans are structured.

Unsurprisingly, monthly payments are the most popular choice, likely because this aligns with standard pay cheque frequencies. Biweekly payments come in second place as opposed to weekly, which are chosen by 10.6% of customers. This goes hand in hand with common pay cycle frequencies in the United States, as 43% of employers choose biweekly pay periods.

Customizable payment plan frequencies also have the added benefit of aligning with the growing gig economy in the United States, which now makes up 36% of the entire population. A shift towards freelancing or contract work means that fixed, monthly income is no longer the norm and irregular income streams are becoming more common.

What does this mean for collections in post-charge off accounts? If you want customers to pay, offering autonomy and choice is key to helping them find a way forward.

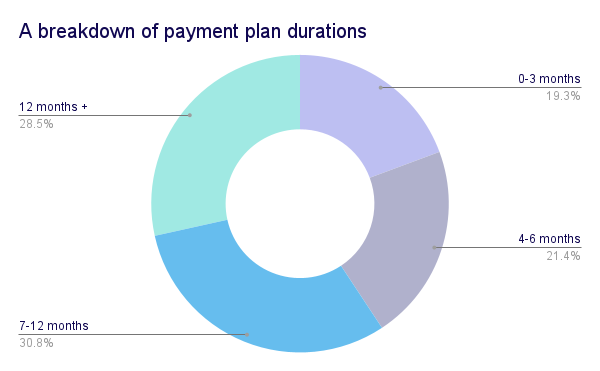

Should payment plans be capped?

Offering true flexibility means more than just letting customers choose the frequency of instalments in a payment plan. Most collections agencies offering payment plans will cap the duration to 12 months. With InDebted, customers can decide how long their payment plan should last, rather than being forced into a shorter plan - which means higher (and potentially unsustainable) instalments. While 65.7% of post-charge off customers complete their payment plans within 12 months, we don’t limit them to this timeframe.

We believe there’s more benefit in supporting customers to set up a payment plan that works for them, rather than enforcing limitations which they may not be able to meet - which can make them disengage and withdraw from paying their debt back entirely.

Our data shows that by giving customers choice in their payment plan length, an additional 28.5% can be supported to get back on track.

The only assumption in post-charge off collections

In post-charge off collections, all pre-conceptions should be left at the door. While traditional collection strategies rely on linear thinking of how customers are expected to engage, an intelligent approach enables all possible outcomes.

The only assumption? That nobody really wants to be in debt. They just need to be provided with better options to clear it in a way that works for their individual situation - especially when it comes to older debt types.

Learn moreJoin our newsletter for the latest collections insights

Thank you for subscribing!

Learn how collect can work for your business

Get in touch to request a demo, where we’ll walk you through key features and functionality.

Book a demoJoin our newsletter for the latest collections insights

Thank you for subscribing!