How InDebted powers the BNPL industry’s strongest collections performance

Client profile

InDebted partners with a publicly-listed BNPL provider whose mission is to power an economy in which everyone wins. With over 20 million active customers worldwide, InDebted supports their collections needs in Canada, Australia, New Zealand, and the United States.

Challenge

This BNPL provider sets a high benchmark for customer experience and frictionless repayments in the digital world, so they require a collections partner who can mirror their values, focus on customer experience and drive unmatched collections results.

Solution

InDebted’s intelligent debt collection product is a fitting match, as it’s intuitive to how people choose to engage with their overdue accounts. Their customers are provided with an intuitive, frictionless and empathetic way to manage their debt, their way. And when the results delivered by InDebted are compared to the BNPL providers’ other collections agency, InDebted is also proven to out-perform their cumulative MoM liquidation for an entire year.

Impact

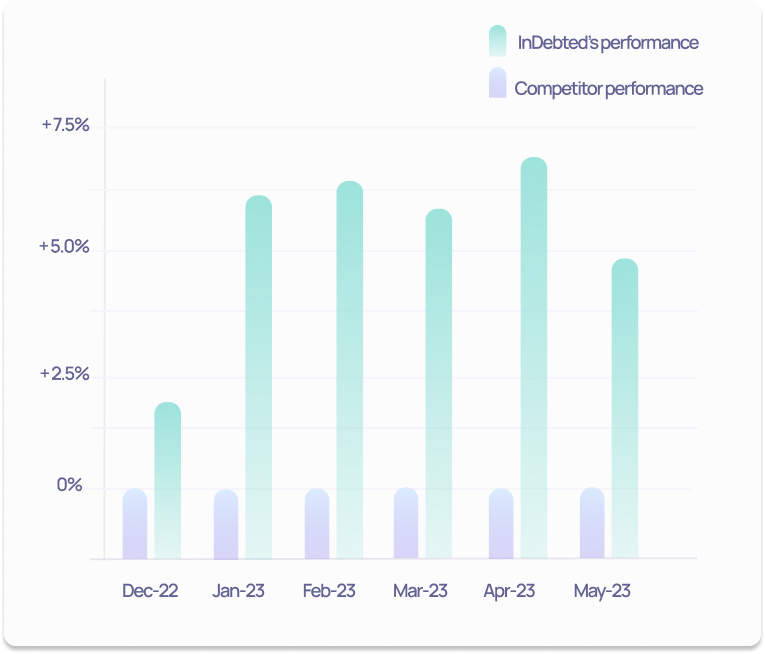

InDebted is one of two credit collections agencies in the United States who work with this BNPL provider, receiving allocations within the same portfolio mix. This enables the BNPL provider to monitor comparative performance between the two agencies. From data tracked by the BNPL provider between InDebted and their other collections agency during June 2022 to May 2023, InDebted was the strongest overall partner for cumulative liquidation in 12 out of 12 months, outperforming our direct competitor by a monthly average of over 5%.

InDebted’s outperformance of direct competitor for cumulative liquidation from Dec-22 to May-23

In addition to being compared for liquidation performance, InDebted is also scored on factors such as compliance, quality assurance, company stability and the quality of our data reporting, all of which see consistent strong results.

Summary

Organisations such as this BNPL provider work with InDebted because of the results we deliver while maintaining a consistent focus on customer experience.

I wish every company used you guys. Debt collection is never an enjoyable experience, especially since it usually happens when you’re at your lowest low (in life overall), but you guys have made it simple and painless. I actually felt encouraged - not pushed - to resolve this. I can’t say I’ve ever felt that before from a debt collector. The flexibility of setting payments up on my own (instead of having to shamefully call someone) let me actually feel in control of my finances again for the first time in a long time, which actually gave me a sense of hope. I really needed that.

Join our newsletter for the latest collections insights

Thank you for subscribing!

Learn how collect can work for your business

Get in touch to request a demo, where we’ll walk you through key features and functionality.

Book a demoJoin our newsletter for the latest collections insights

Thank you for subscribing!