The future of enterprise first-party collections

Trusted by organisations around the world

Expectations have evolved. First-party collections haven’t.

Receeve is an AI-native first-party debt collection solution designed for enterprise lenders, fintechs, telcos, utilities and government organisations. It helps teams improve recoveries, reduce operational cost and deliver a modern experience across the entire first-party collections journey.

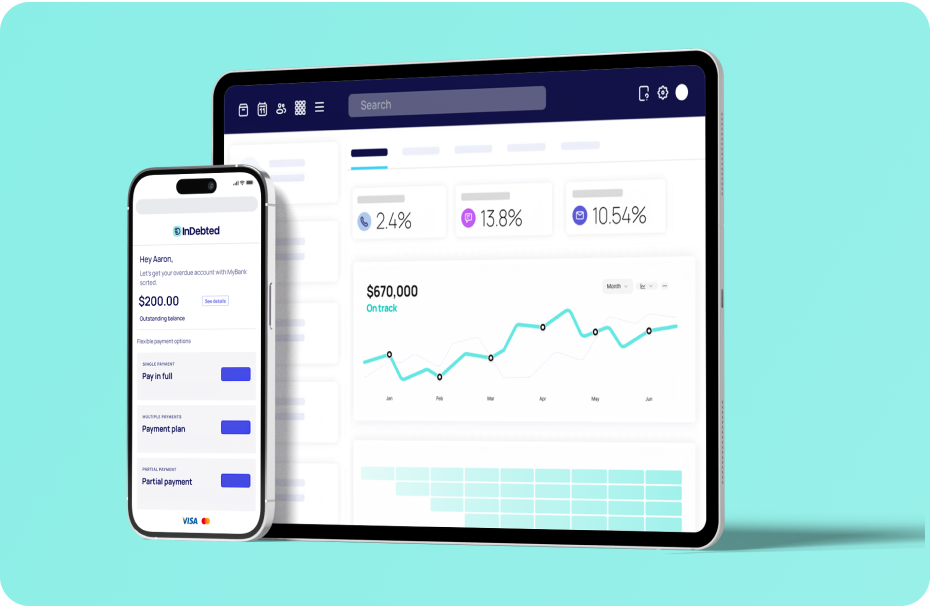

Digital-first experiences

Improve self-service and reduce friction, with personalised, intuitive journeys that reflect how customers prefer to engage.

Higher recoveries

Increase performance and reduce operational cost with integrated strategies that focus effort where it matters most.

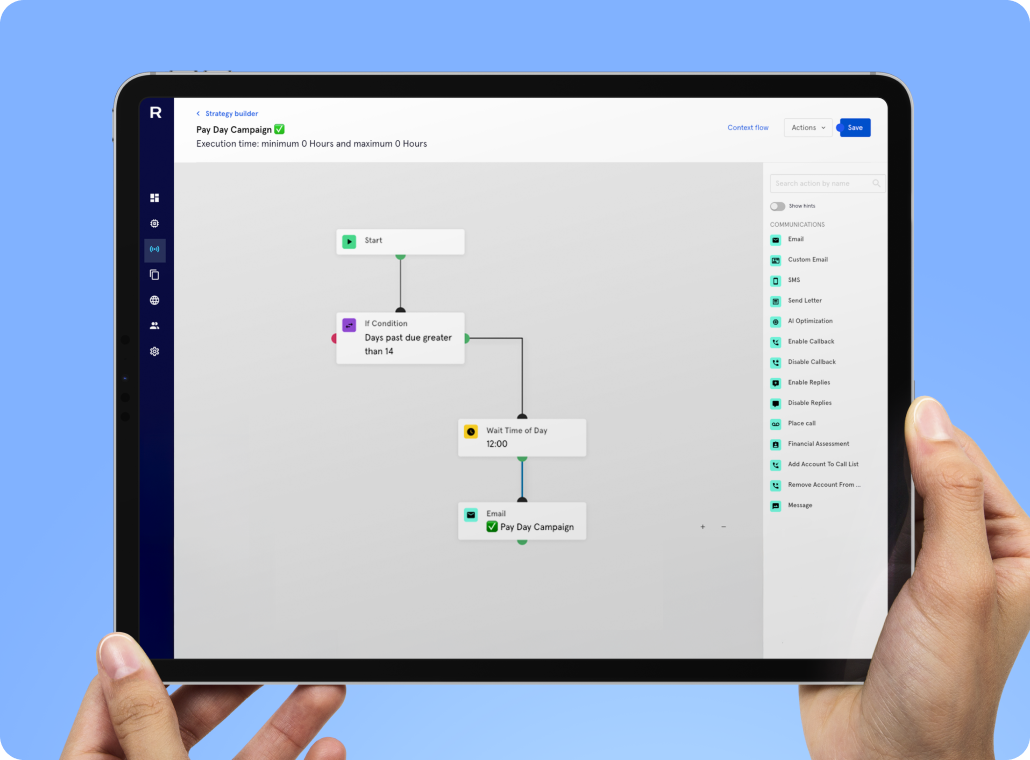

Advanced decisioning

Use predictive intelligence and real-time insights to create strategies, optimise performance and make faster, more confident decisions.

Why enterprises choose Receeve

Looking for third-party?

If you need a fully managed collections service, Collect is our next-generation alternative to traditional agencies — ideal when you want speed, simplicity and results without building internal operations.

White glove implementation

“With Receeve, we can address the process end-to-end. We’re ensuring our collections and recovery is optimised for customer preferences, utilising the latest technology to help resolve issues in the best manner possible.”

Christian Grobe

Co-founder & Managing Director

Trusted by leading businesses

“Embedded finance has become more mainstream and AI-powered technologies help understanding customers’ needs. Receeve provides our partners a seamless solution to address credit management end-to-end, with the best user experience top of mind.”

Sergey Zhuravskiy

Head of Dunning & Collections

Receeve is an AI-native first-party debt collection solution that helps enterprise lenders, telcos, utilities, BNPL providers and government agencies automate workflows, improve recoveries and deliver digital-first experiences.

Through AI decisioning, behavioural modelling and automated workflows that prioritise the right actions, channels and customer segments in real time.

Banks, fintech lenders, BNPL providers, telco and utilities companies, government organisations and any enterprise operating first-party collections at scale.

Yes. Receeve includes full governance over workflows, strategies, permissions and AI use, with complete auditability for compliance-critical industries.

Receeve powers internal first-party collections operations. For outsourced recoveries, InDebted’s Collect solution provides a fully managed third-party alternative.

Explore Collect