Now more than ever, it’s time for credit providers to reassess their collections strategy to ensure it can withstand the flow on effects of a few tumultuous years going into 2024. Keep reading to learn how to prepare, what’s in store, and our expert tips.

Rédaction

Restez au courant de nos grandes actualités, annonces et couverture médiatique récente

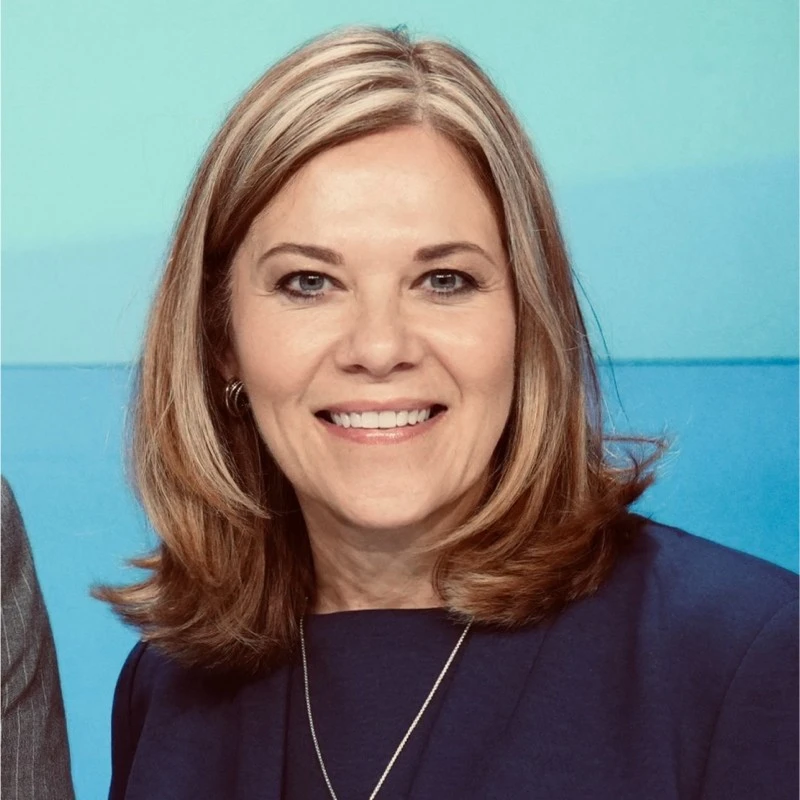

Strengthening our Legal, Risk and Compliance function

We’re proud to have not just one, but two highly regarded leaders in the Risk, Compliance & Legal remit at InDebted. Laura White has joined InDebted as Chief Risk and Compliance Officer, while Tim Collins has been appointed as General Counsel.

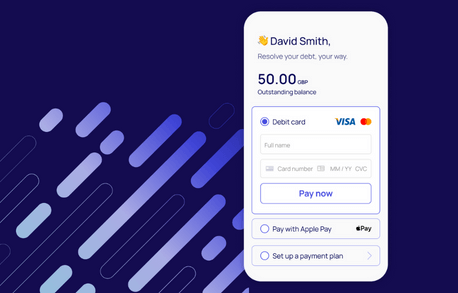

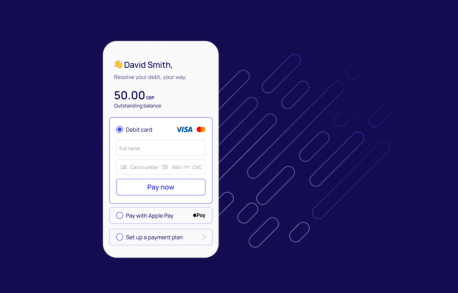

InDebted launches into the UK, finding that 2 in 3 Brits dealing with existing debt collectors experience “stressful” treatment

Read findings from new research that highlights the impact of the broken debt collection industry in the UK on consumers

InDebted Secures $25M in Series B Funding

Read how InDebted hit a funding milestone, to continue changing the world of consumer debt recovery for good

Consumer finance fintech InDebted named Australia’s best place to work

Debt collector named as Australia’s best place to work

Digital debt collection agency InDebted arrives in the UK aiming to improve sector image

Intelligent debt collector launches in the UK to create positive collection experiences for UK consumers

Disrupting debt collection in the UK with CSO Lachlan Heussler on the 11:FS podcast

Australian debt collector launches in the UK features on 11:FS podcast

Global Fintech Interview with Tim Collins, Chief Customer Officer at InDebted

Debt collection trends and how technology can be used to improve the customer experience in collections

Two in three consumers find debt collections ‘stressful’

New UK debt collection research finds that 2 in 3 find debt collectors stressful

Why InDebted is Australia’s best place to work

InDebted named as Australia’s best place to work by Australian Financial Review