HOW IT WORKS

Turn intelligence into outcomes that matter

Receeve combines AI decisioning, behavioural intelligence, digital-first engagement and specialist execution to modernise first-party debt collection operations. Here's how we transform data into better customer experiences and stronger performance.

Data in

Receeve securely ingests your customer, account and communication data - no complex restructuring required.

AI decisioning

Our AI analyses behaviour, predicts the next best actions and adapts strategies in real time to maximise performance.

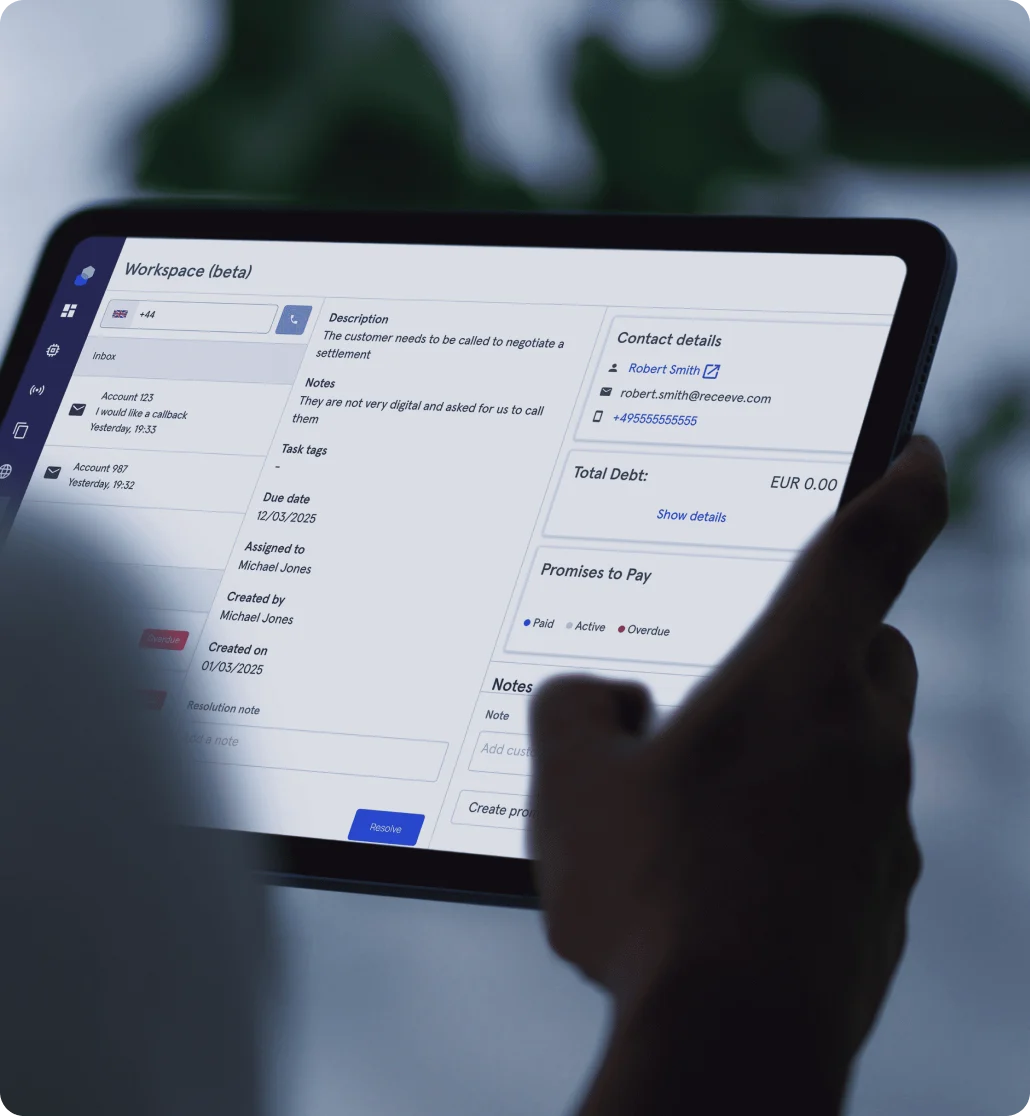

Specialist execution

Our regional collections specialists design and refine execution to ensure decisions translate into real performance gains.

Continuous optimisation

Every interaction feeds back into the system, improving engagement and compounding performance over time.

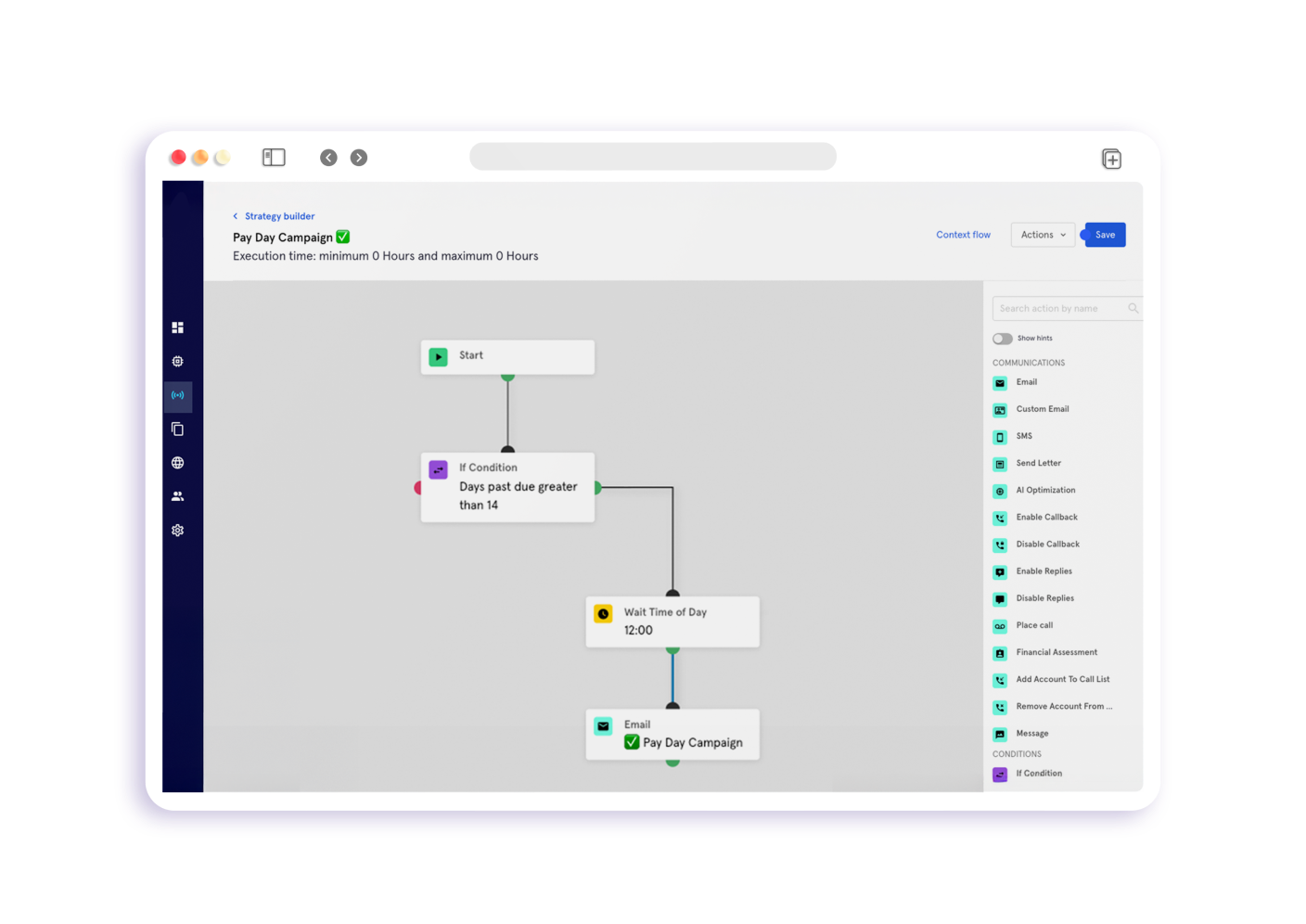

Digital-first journeys that deliver stronger results

Enterprise-grade control

Insights to strengthen every decision

Unlimited analytics

With over 130 dashboards available, we surface the trends that matter, giving you clear visibility into what’s driving engagement and performance.

Lifecycle management

Whether you’re optimising early-stage strategies or testing new channels, our team provide recommendations to optimise each stage of the lifecycle.

Scale across volumes & regions

We ensure consistency and clarity across markets and portfolios — helping you operate first-party collections at scale without added complexity.

Receeve applies behavioural scoring, segmentation and next-best-action modelling to guide outreach, strategy and optimisation across the lifecycle.

Customer, account and communication data — structured or unstructured — to personalise journeys and power AI decisioning.

Yes. Receeve enables consistent, compliant treatment with contact limits, permissions, audit trails and alignment with ISO, PCI DSS and GDPR standards.

Yes, Receeve supports multi-region operations with consistent governance, analytics and automated workflows.

Through digital-first, omnichannel pathways that adapt based on behaviour and optimise with every interaction.

Contact limits and compliance regulations built-in

Contact limits and compliance regulations built-in