SCALE

Scalable collections, without compromising performance or quality

We support multiple markets and uncapped volumes—built for high-growth or global organisations.

SCALABLE SUPPORT

Don’t let collections be your bottleneck

Client story

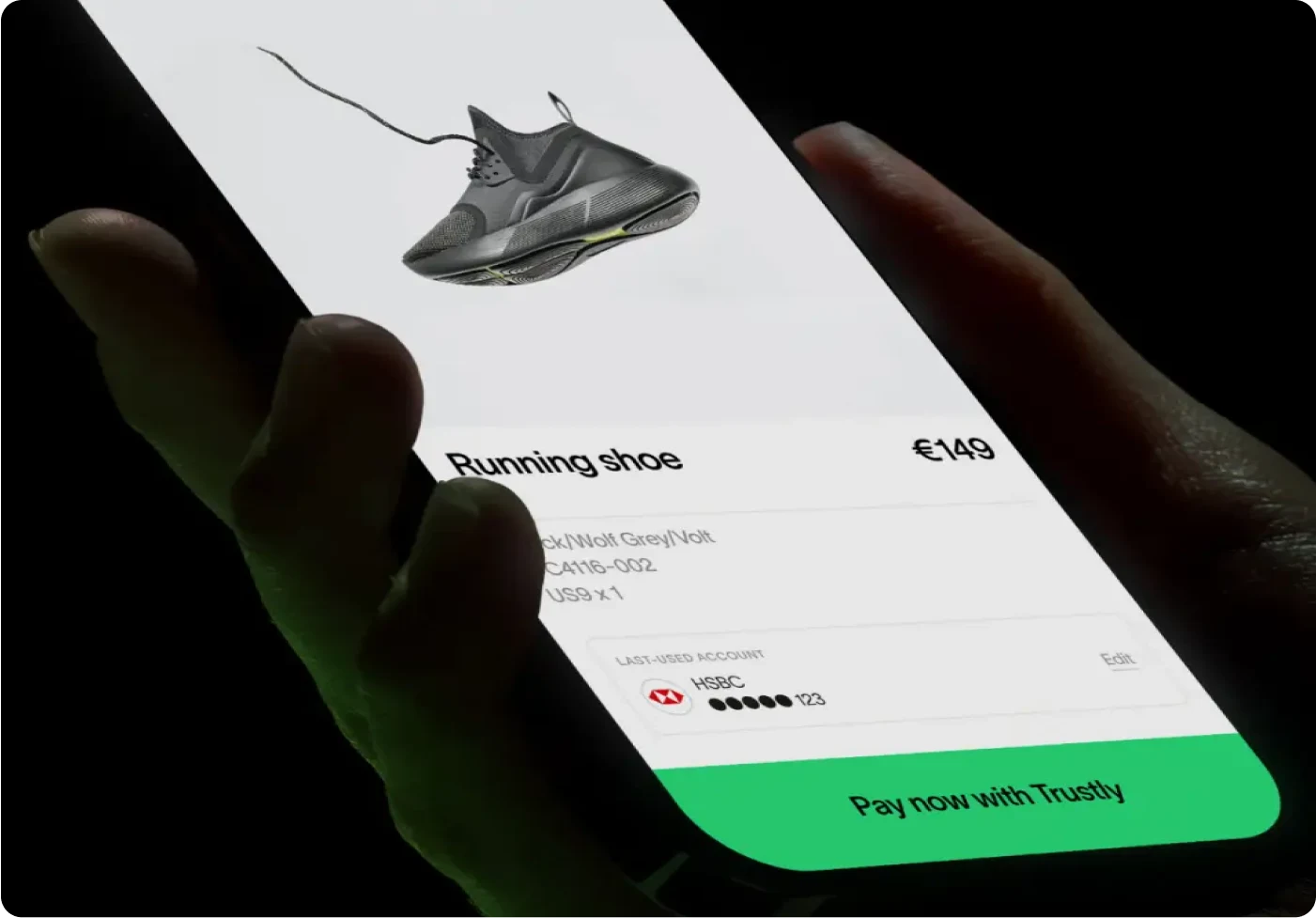

Trustly partners with InDebted to uplift their collections performance 20x

“We want to empower our customers to resolve their overdue balances in a way that truly works for their circumstances. InDebted makes that seamless. Finding a collections partner that can support our growth, while still providing an exceptional experience for our customers is a win-win.”

Rakesh Teckchandani

Senior Director Risk Product

Challenge

- 2023 was a year of rapid growth for Trustly, reaching $58 billion in annual transaction value – a 79% YoY increase.

- In this period of growth, their monthly collections referrals increased 12x.

Impact

- Trustly’s collections performance increased 20x, successfully recovering $4 million USD in otherwise lost revenue.

- During this period, 70% of Trustly’s paying customers self-served their accounts, and 4 out of 5 have resolved their balance in full.

CUSTOMER EXPERIENCE

Human-centered, transparent and secure AI

We make it easy for customers to resolve their account with an intuitive, personalised experience.

Explore Collect’s AI

BORDERLESS COLLECTIONS

One solution, multiple regions

REGIONS

Explore collections in your market

Client story

Klarna chooses InDebted as their preferred collections partner across multiple markets

Challenge

Active in 45 markets worldwide, Klarna needs a collections partner that can:

- 1. Service their global customer base

- 2. Maintain strong collections performance

- 3. Ensure compliance with regulations in different markets

Impact

- A custom third-party extension to seamlessly transfer customer data from Klarna’s systems to InDebted

- Partnership in the United States, Australia, Canada and New Zealand

- 97% of paying Klarna customers self-serve their outstanding accounts, without contacting an agent for payment

Get more customers back on track

Find out how Collect can support your current and future collections needs.