MEXICO

The AI-first collections solution for Mexico’s fintech leaders

A smarter way to collect

“We are thrilled to partner with InDebted as we continue our journey to redefine financial empowerment in Mexico. Their innovative, consumer-first approach to debt collection aligns seamlessly with our values of transparency and trust.”

Angel Peña

CEO

Trusted by leading businesses

High-growth organisations partner with InDebted to offer their customers a modern collections experience.

See the customer experienceRethinking debt collection in Brazil, Mexico and Colombia

“As a global debt collection agency, partnering with InDebted has saved us the time, cost and inefficiencies of needing a new supplier in every region. InDebted is a key part of us delivering our customers a better way to shop, globally.”

Jan Hansson

VP, Collections

Jag Khangura

Senior VP, Global Expansion & Managing Director, Canada

Stuart Ahmet

New Markets Lead

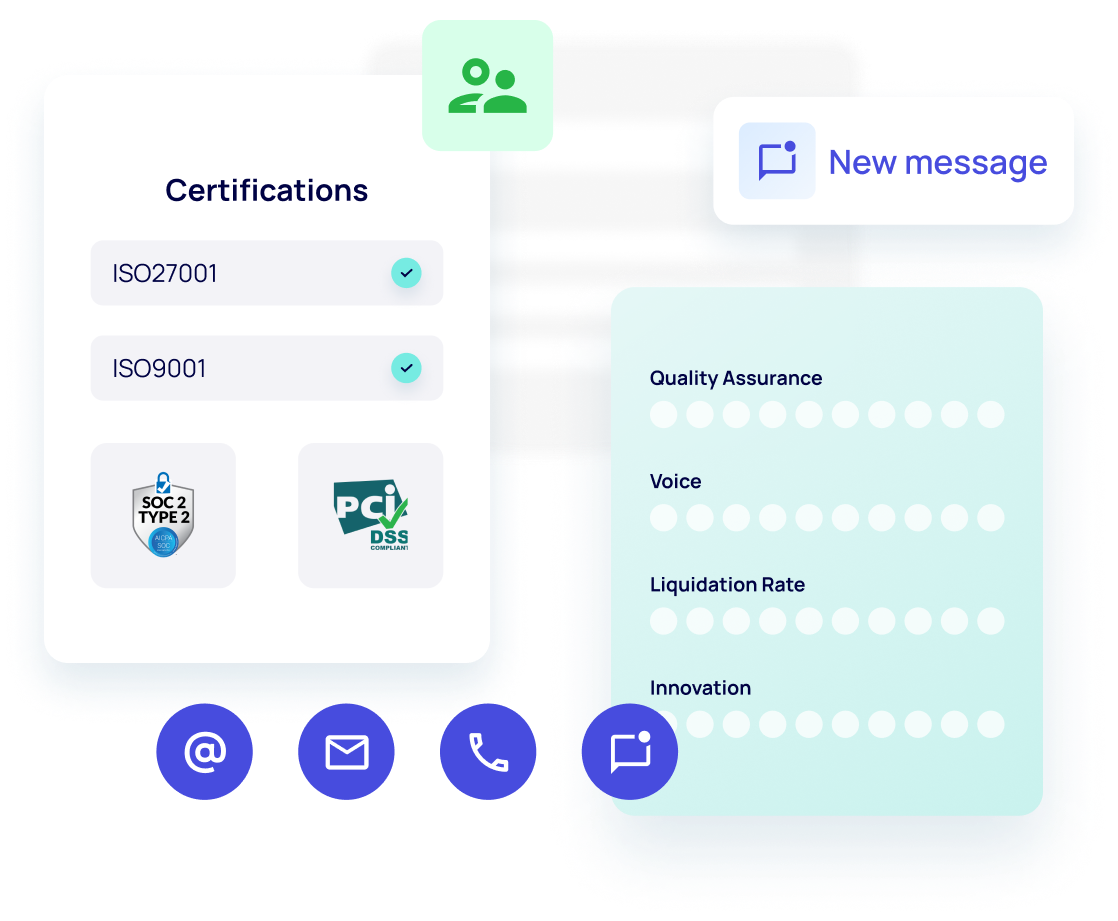

Industry-trusted compliance

InDebted is the AI-powered alternative to traditional debt collection agencies in Mexico. Instead of relying on call-heavy or manual based methods, we use digital-first engagement, self-serve payment portals and omnichannel communication across SMS, WhatsApp, email and voice. This gives Mexican consumers a more respectful, modern experience while helping businesses achieve higher recovery rates.

Fintechs and BNPL leaders such as Aplazo partner with InDebted because we combine advanced AI with a customer-first approach. Our solution is built to support the rapid growth of digital credit in Mexico, helping lenders recover more while protecting consumer relationships. By offering flexible payment plans and sustainable repayment options, we enable businesses to scale responsibly and strengthen trust with their customers.

Our proprietary AI analyses billions of customer interactions to predict the best way to engage each consumer. In Mexico, this means tailoring communication for local preferences — for example, prioritising mobile-first channels, offering flexible payment options, and outreach timing to match customer behaviour. AI also supports proactive vulnerability detection, ensuring consumers receive the right support when they need it.

We work with high-growth fintechs, BNPL providers, financial institutions and debt purchasers across Mexico. Our platform is designed for modern businesses that want a digital-first alternative to traditional agencies, with proven success in delivering higher liquidation rates and better customer outcomes.