UNITED STATES

The AI-powered alternative to US debt collection agencies

Modern replacement for first-party systems

Enterprise-ready collections infrastructure, combining intelligent software with consultative support to deliver smarter strategies, stronger results and better control.

Explore Receeve

AI-powered, human centered outsourcing

Third-party collections with intelligence, experience and compliance at its core, consistently outperforming traditional agencies.

Explore Collect

“As a global debt collection agency, partnering with InDebted has saved us the time, cost and inefficiencies of needing a new supplier in every region. InDebted is a key part of us delivering our customers a better way to shop, globally.”

Jan Hansson

VP, Collections

Brad Bone

President, InDebted USA

Charlie Allen

Director of Client Solutions

Colene McNinch

Director of Business Operations & Compliance

Toni Metzger Lewis

Client Solutions Director

Mike Zhou

VP of Data and AI

Jon Avery

Director of Collections

Trusted & secure

Smarter internal collections, managed for enterprise

The best of voice and digital, in one intelligent solution

40% uplift with omnichannel

Compared to voice-only strategies, see up to 40% higher performance with personalised omnichannel engagement tailored to each customer.

Intuitive campaigns

Enter a new era of voice intelligence. High performing strategies with personalised offers, better outcomes and a 5-star customer experience.

86% self-serve rate

Cure low risk accounts faster, with over 4 in 5 resolving without speaking to an agent - making it easier for customers to repay, their way.

Trustly improves collections performance and scales referrals 12x

“We want to empower our customers to resolve their overdue balances in a way that truly works for their circumstances. InDebted makes that seamless. Finding a collections partner that can support our growth, while still providing an exceptional experience for our customers is a win-win.”

Rakesh Teckchandani

Senior Director Risk Product

Find licensing information where you operate

Select a state to find more information

InDebted is the AI-powered alternative to traditional debt collection agencies in the US. We partner with leading businesses, using advanced technology to improve recovery rates, create better customer experiences and ensure compliance. Our approach moves away from outdated legacy methods and into a modern, customer-first future.

See the experience

Businesses like Klarna, Upstart and more choose InDebted because we combine advanced AI technology with a true partnership approach. Our expert team has decades of specialist collections experience, from strategy and operations to compliance.

Alongside dedicated industry expertise across telecommunications, financial services, fintech and utilities, InDebted’s innovative technology enables leading brands to take their collections strategy further while preserving customer relationships. This approach leads to stronger performance, greater transparency and a focus on protecting your brand reputation, setting us apart from traditional agencies.

Read our client stories

Yes, outbound voice is an integral part of our collections strategy. InDebted uses a hybrid approach that combines advanced digital engagement with targeted, strategic outbound calls. We use AI and machine learning to identify which customers are most likely to respond to voice, so our teams can focus on high-impact conversations while minimizing unnecessary contact. This leads to better outcomes for our clients and a more respectful experience for consumers.

Explore Omnichannel

Our AI personalizes every customer interaction to improve collections strategies, increase engagement and reduce operational costs for US businesses. This helps boost collection rates and gives both companies and customers a smoother experience.

Learn more about Collect’s AI

We partner with a range of US businesses including fintech, telecommunications, payments, financial services and utilities. Our solutions are designed to deliver digital-first collections for companies looking for innovation, compliance and a focus on the customer experience.

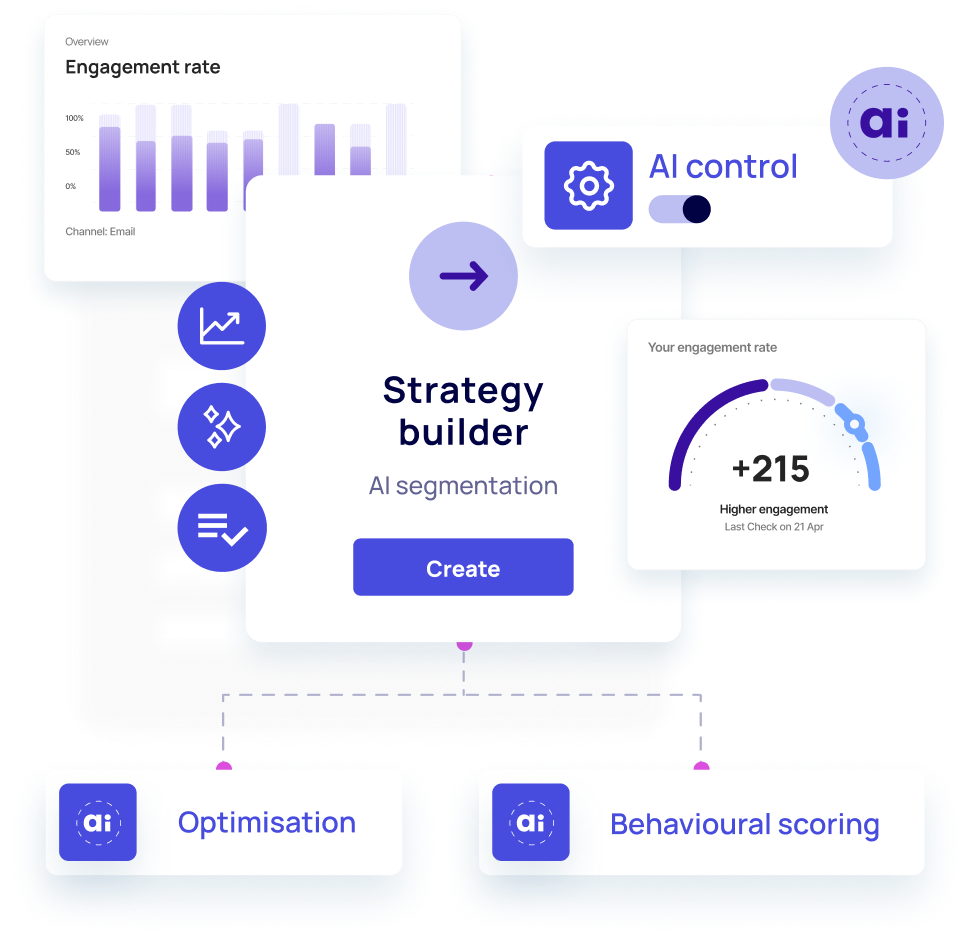

Personalised engagement sharpened by AI behavioural scoring

Personalised engagement sharpened by AI behavioural scoring