UNITED KINGDOM

World-class third party collections and customer care

Support customers, without compromising liquidation

“As a global debt collection agency, partnering with InDebted has saved us the time, cost and inefficiencies of needing a new supplier in every region. InDebted is a key part of us delivering our customers a better way to shop, globally.”

Jan Hansson

VP, Collections

A better experience for your customers

Vulnerability detection

Collect’s AI proactively flags customer accounts in need of support, fast-tracking them to specialist attention.

Flexible payment options

Custom start dates, payment amounts and frequencies are all part of the payment experience.

Agents who care

The industry’s highest rated customer experience, with a 4.9 average from over 2,700 5 star reviews.

Emma Atkin

Executive Vice President, Marketing & Managing Director, UK

Nick Krauspe

Director of Compliance & Operations, UK

Stuart Ahmet

New Markets Lead

A better experience for energy customers

“The agent was amazing in resolving the challenge I faced in a friendly and understanding manner. Now resolved and in a very stress free way. Not an easy recommendation given the nature of the engagement and the current financial climate but if you have go through it, better resolved using InDebted. 10/10”

InDebted is the AI-powered alternative to traditional debt collection agencies in the UK. We combine digital-first engagement, self-serve portals and flexible repayment options with a strong compliance framework. This approach helps businesses recover more, while ensuring customers are treated fairly and respectfully.

Future-thinking organisations like Fluro partner with InDebted because we deliver collections that balance performance with customer care. Our AI-driven approach helps clients scale, protect their reputation and maintain compliance, while giving customers flexible, sustainable repayment journeys. This makes us the partner of choice for BNPL, fintech and financial services leaders across the UK.

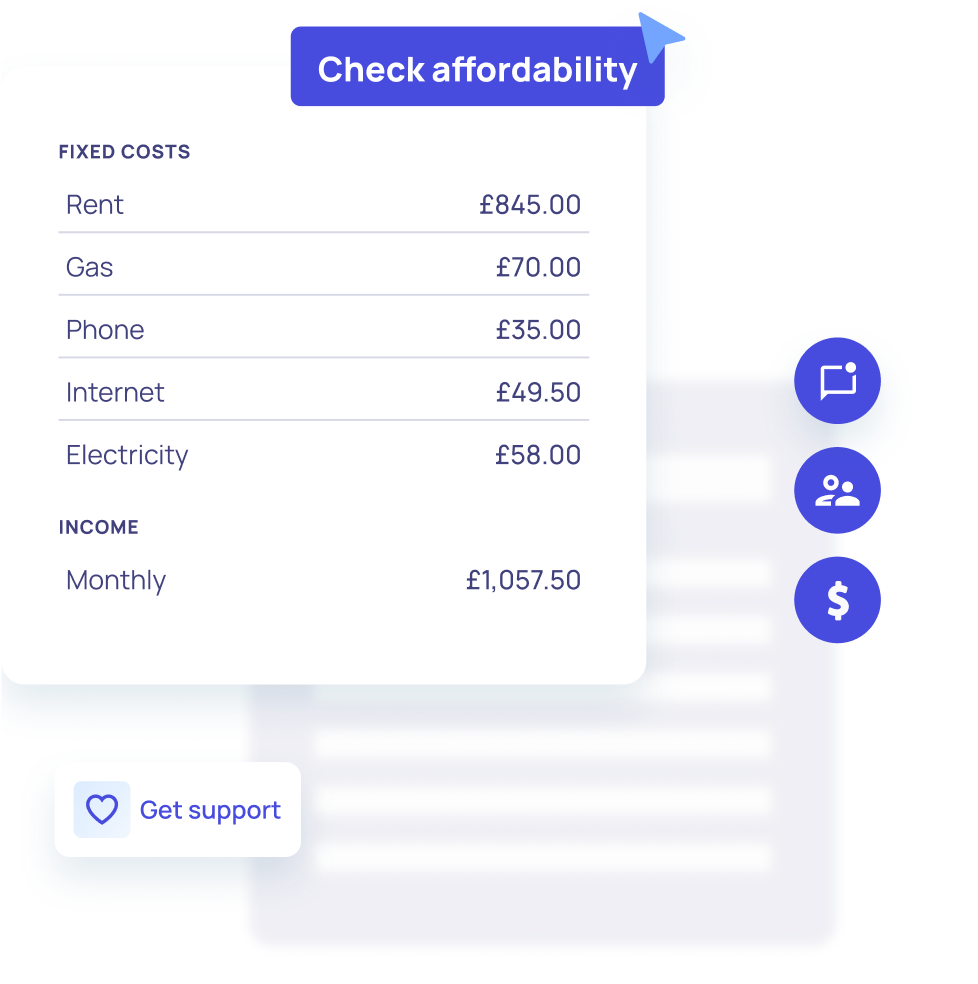

Our proprietary AI powers every stage of the collections journey. In the UK, this includes affordability assessments, personalised repayment plans and omnichannel engagement across SMS, email, WhatsApp and voice. AI also enables proactive vulnerability detection, helping businesses meet regulatory requirements while giving customers a smoother, more supportive experience.

Yes. Voice is an important part of our hybrid collections strategy in the UK. We use AI to determine which customers are most likely to respond to voice calls, so voice is applied strategically. This improves performance for businesses, while ensuring customers only receive relevant, respectful outreach.

We work with BNPL providers, fintechs, financial services firms and utilities in the UK. Our solution is designed for growing leaders that want a digital-first, AI-driven alternative to traditional agencies, with built-in compliance, delivering stronger outcomes for both businesses and customers.